Overview

Boston, MA

August 2005

PROCESSOR VALUE ADDED SERVICES

What Should Issuers Outsource and What Can Processors Provide Most Effectively?

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Both the card issuing and transaction processor industries are consolidating at a rapid rate, and this activity has created a growing demand for processor value added services. For issuers, slowing portfolio growth is putting pressure on earnings growth. To meet their aggressive goals, issuers are searching for ways to make their current account base more profitable through increased transaction volumes, better cross-sell marketing and tighter expense controls (especially credit losses).

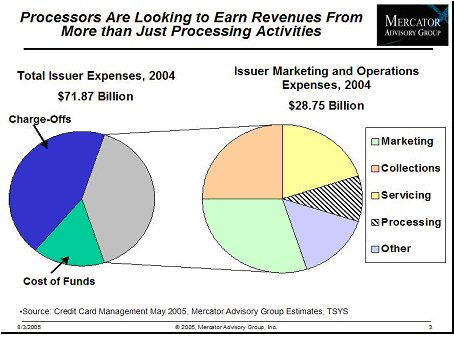

Processors have similar growth problems. The two largest processors have now acquired almost all of the third party processing business, so there is little market share left to grab. At the same time, the number of active accounts has been flat for several years, so processors are finding few new accounts to process. The result is a concerted effort to expand their revenue sources as far beyond core processing as possible. Figure 2 shows the breakdown of issuers expenses in 2004, and demonstrates why processors would like to expand beyond simply core processing.

One of seven exhibits included in this report

Figure 2: Processing represents only 4.5% of total issuer spending

The report contains 29 pages and 7 exhibits.

The result has been an increase in the market for value added processor services. Issuers need help driving profitability, and processors are in a position to use their scale and transactional expertise, as well as their key position in the card industry value chain, to assist them. Processors have increased their efforts to provide a broad spectrum of new services, from pure cost reduction programs (like data warehousing and implementation of association compliance mandates) to complex data analytics services on top of the core processing activities (like risk prediction, fraud detection, loyalty and marketing programs).

The report seeks to answer several key questions:

* How should we define process value added services?

* Which services are issuers currently outsourcing, and why?

* How much do issuers currently spend, and how are these spending habits changing?

* What services are most likely to be outsourced to processors in the future and why?

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world