Overview

Programming the Payment:

From APIs to Commerce Platforms

New research from Mercator Advisory Group reviews software development platforms and payment innovation

Boston, MA -- The increasingly rapid shift of payment activity to the Web and mobile devices relies upon the talent of software developers creating the integrated customer experience that consumers, merchants, issuers, card networks, and payment processors demand. Tools for developers that ease payment integration attract entrepreneurs and enterprise software developers to particular payment service providers.

Mercator Advisory Group's new report Programming the Payment: From APIs to Commerce Platforms, examines the expanding array of providers that are helping programmers program the payment. The report reviews offerings from top card networks, payment processors, and payment services providers for e-commerce, mobile, and point-of-sale payment applications. Issues of identity, branding, and API management are addressed as well as the merger and acquisition activity of several major players.

Highlights of this report include:

New opportunities for software developers to leverage payment capacities created by the proliferation of e-commerce, mobile commerce, and cloud-based wallet schemes.

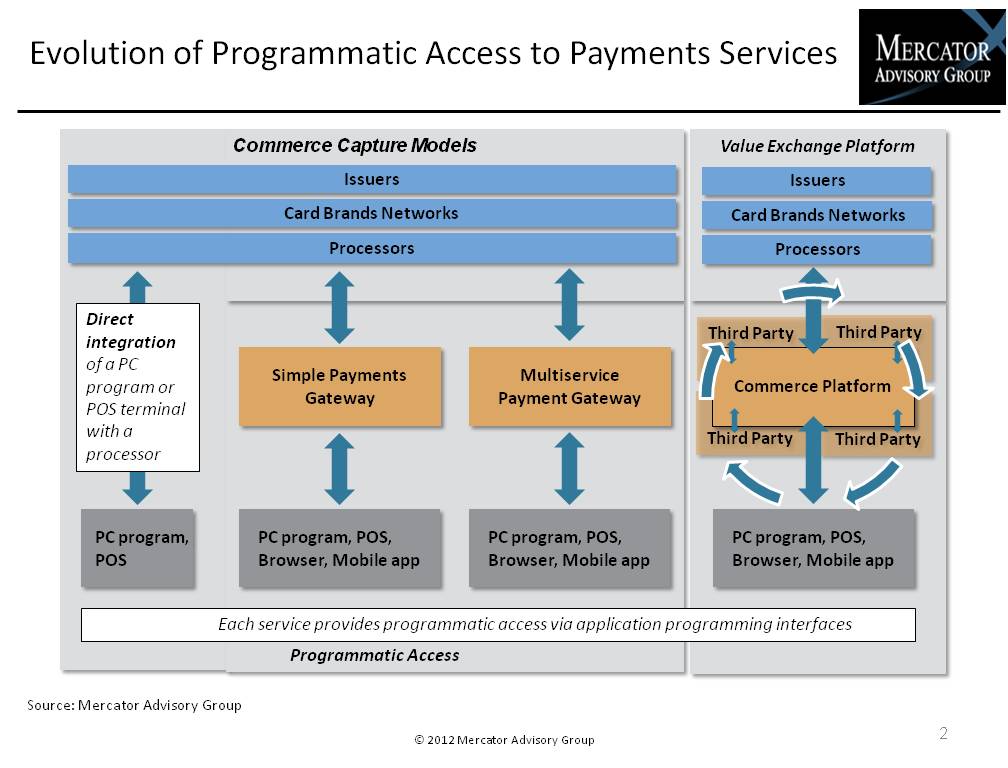

The two major categories of business models for companies offering payments and commerce services to developers

The changes that variants of the commerce capture model enable for e-commerce and mobile commerce applications

Changes that many entities, such as IP Commerce, are making as result of the shift in activity from e-commerce transactions to point-of-sale and mobile commerce

"Software developers are a strong source of payment innovation and a growing source of payment transaction volume," states George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "Payment processors hope to capture commerce via this channel through programmatic interfaces. As the definition of a transaction expands beyond the payment alone, commerce platform providers take it one step further to enable value exchange among all participants.

One of five exhibits in this report:

This report is 28 pages long with five exhibits.

Companies mentioned in this report include: Chase Paymentech, Vantiv, First Data, Amazon, Cycle Computing, PayPal, Apigee, IP Commerce, Mashery, Heroku, dotCloud, eBay, Visa, MasterCard, American Express, VeriFone, MICROS, S1, AJB, Inkiru, Stripe, SeerGate, Facebook, Google, Twitter, Isis, and LinkedIn.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world