Overview

Rattling the Value Chain: The Effects of New Regulations on Open-Loop Prepaid Programs

Report Examines Recent Regulatory Changes and Their

Effects in the Prepaid Value Chain

Boston, MA -- In new research, Rattling The Value Chain: The Effects of New Regulations on Open-Loop Prepaid Programs, Mercator reviews recent regulatory changes that have shaken up the open-loop prepaid industry. The new regulations have affected all the companies that work together to operate prepaid programs, and this report explores new issues they will face.

The goal of this report is to help prepaid card companies all along the value chain make sense of the new regulatory environment. As Mercator examined existing programs in light of the new regulations, common issues were uncovered as well as others that were specific to different companies involved and the features and functions offered by the programs.

To uncover how the industry can make sense of the new regulatory environment, the report starts with a review of three recent regulatory developments, and then discusses ways in which they might affect the different companies in the prepaid value chain.

Highlights of this report include:

The three recent regulatory actions have shifted the landscape for open-loop prepaid cards.

How these regulatory actions will change the way that the members of the prepaid value chain relate to one another.

The new costs, business model alterations, and restrictions that will come with implementing the rules of the Durbin Amendment.

New requirements, including more reporting and record keeping, resulting from the Financial Crimes Enforcement Network's (FinCEN) final rules.

Steps financial institutions must implement to comply with the OCC guidance.

"This past summer was a rough one for the prepaid industry in terms of regulations affecting open-loop prepaid. The closed-loop side of prepaid has faced its own regulatory troubles with the rules implementing the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009. Now, it is open-loop card companies that need to take time with dense government regulatory documents to determine what to do next," says Ben Jackson, senior analyst of Mercator Advisory Group's Prepaid Advisory Service.

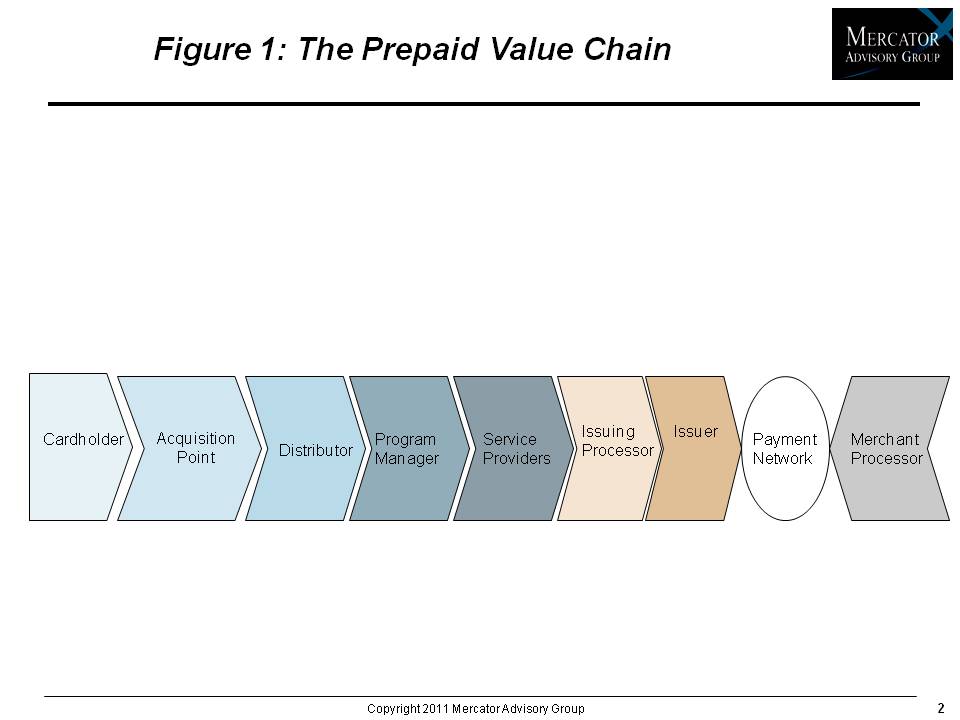

One of five exhibits in this report:

This report is 28 pages long and has five exhibits.

Companies mentioned in this report include: American Express Inc., Billeo, Inc., Green Dot Corp., Mango Financial Inc., and NetSpend Holdings Inc.

Members of Mercator Advisory Group's Prepaid Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world