Overview

Boston, MA

May 2008

A Reminder to Canadian Banks: More Benchmarking and Less Acquiring

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The third report from Mercator Advisory Group's recently launched Retail Banking Practice delivers an incisive analysis of the challenges confronting the Canadian banking industry. For Canadian bankers, there is a tempting confluence of market conditions that is best resisted. Mixing the weak U.S. dollar with the battered balance sheets of U.S. banks and then stirring that potent mixture with the strong Canadian dollar makes relatively inexpensive U.S. banking assets tantalizingly appealing. However, Canadian banks hoping to bolster their global ranking by picking up deeply discounted U.S. banking assets should be fully prepared to walk away from this market cycle with nary a new U.S. bank in their portfolios.

As Canadian banks eye U.S. acquisition opportunities in this weak-dollar environment, they must be vigilant to the diminishing effects of economies of scale achieved through each additional unit of acquired bulk. In addition to issues of size, bankers must always critically evaluate each incremental strategic benefit gained by merging a U.S. brand into an existing Canadian branch network and business system. A chorus of nationalistic and profit-seeking stakeholders is pushing and prodding Canadian banks to buy and grow their businesses and those voices must be resisted until, or if, they are shown to be well-reasoned and right thinking. And finally, Canadian banks must resist the ease of benchmarking exclusively against U.S. bank operations. The global banking industry does not need a North American banking model.

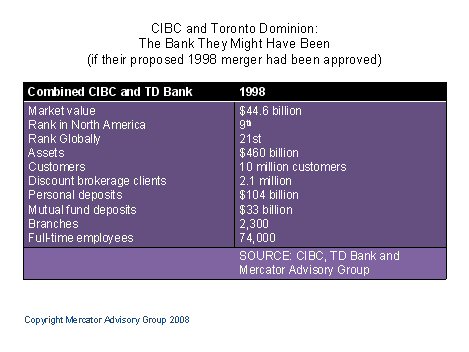

In 1998, the Canadian government rejected proposed mergers involving the four largest Canadian banks. Merger enthusiasts were confounded. Post-1998, the banks that would have merged reactively engaged in expensive brand-stretching and growth initiatives that cost their shareholders millions. Acting up and acting out is understandable, but in the case of the Canadians, it was a costly pout.

In the past, when Canadian banks have responded to the chimera of making can't-miss, sure-fire U.S. acquisitions from a shaky viewing platform constructed of hurt pride, asset and growth envy and analyst hurrahing, they have made ultimately expensive and humbling missteps.

Ironically, while some Canadian banks believe that their banks have been restricted from bulking up to rival the size of global banks, their constrained sizes may have protected them from some of the excessive levels of exposure experienced by those global players.

In the current market, it is imperative that Canadian bankers resist the drumbeats of market makers promoting the acquisition of relatively cheap U.S. financial institutions while maintaining a second prong initiative to include the banks and emerging technologies of other countries in their benchmarking initiatives.

We posit that Canadian bankers may gain their greatest competitive advantage by resisting the alluring temptation to acquire U.S. banking assets and rather focus on perfecting and marketing micro-expertise.

Develop, not buy.

Being the best in technology deployment, customer service standards and products sold per household remains a long-term shareholder value building a strategy regardless of the deeply discounted bargains to be found south of Niagara Falls.

One of 5 Exhibits included in this report

The report contains 23 pages and 5 exhibits.

Report Highlights:

- For the largest Canadian banks, comparing themselves to their U.S. counterparts has created a case of asset envy that has served as an accelerant of rashly executed acquisition activity.

- After being precluded by their Finance Minister from merging in 1998, the largest Canadian banks rushed into ill-considered mergers and new business line initiatives. Then years later, financial service analysts are clamoring for Canadian banks to buy U.S. banks in this weak dollar environment at deeply discounted prices. Hurried acquisitions are rife with potential for muddled service standards and customer communications and technology. Unless the banks can quiet the acquisitions-now din, they are in danger of repeating the poorly considered and rash actions of 1998.

- It is essential that Canadians resist the ease of principally benchmarking against U.S. banks with their over reliance on ATM and NSF charges and overdraft fees. In addition to benchmarking against the products introduced and marketed in other countries, that cross-border and across-ocean benchmarking should include monitoring regulations, brand messaging, technology innovations and strategies for solidifying stakeholder enthusiasm for strategic directions.

- North American banking practices, product pricing and service expectations are becoming both standardized on the continent and morphing increasingly at odds with the pricing trends of other major banking markets. The global banking industry does not need a North American banking model.

- Wall Street and Bay Street analysts are promoting the same you're-crazy-if-you-don't-merge-or-buy-assets arguments they used 10 years ago and it is critical that Canadian bankers resist the bystanders' chants this time. Responding to the chants was disastrous then and now, would be again.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Service and author of the report, comments, "The largest Canadian banks have found themselves susceptible to two trends: benchmarking themselves too exclusively against the largest U.S. bank holding companies and responding reactively to impulses of their own egos and the instigations of the analyst community to make ill-timed acquisitions and assume new strategic directions.

In the same way Americans and Canadians are aware that they have different health care systems and beer, the bankers of both countries must remain vigilant of the reality that while benchmarking and competing against one another, they must keep a keen eye on the banking pricing and product norms of other markets. The global banking industry does not need a North American banking model.

Among the global retail banking markets, North American retail banks are increasing their prices more sharply than other regions and they are acting in concert with one another. While other markets show price differences of up to 25% between banks, banks in Canada and the U.S. show almost no variation in prices.

In the past, when Canadian banks have responded to the mirage of making can't-miss, sure-fire U.S. acquisitions from a shaky viewing platform constructed of hurt pride, asset and growth envy and analyst hurrahing, they have made ultimately expensive and humbling strategic missteps. A chorus of nationalistic and profit-seeking stakeholders is pushing and prodding Canadian banks to buy and grow their businesses and those voices must be resisted until, or if, they are shown to be well-reasoned and right-thinking.

After being rebuffed by their own Finance Minister in their 1998 attempts to merge their largest banks, the largest Canadian banks barreled into the U.S. market in an almost We???ll-Show-You way. For example, CIBC reacted by diving into high profile investment banking transactions with Global Crossing and Enron and opening supermarket branches across Florida and California. They were strategies that just didn't work. In late 2001, CIBC slashed 4 percent of its workforce, increased its loan-loss provisions by nearly 60 percent, and sold off $1 billion Canadian of unwanted loans and credit commitments. By 2002, the sure-fire supermarket branches were shut down after racking up losses of $600 million Canadian, its first quarterly loss in over 10 years.

As Canadian banks eye U.S. acquisition opportunities in this weak dollar environment, they must be vigilant to the diminishing effects of economies of scale achieved through each additional unit of acquired bulk.

Analysts, shareholders and boards of directors are teeing up a list of reasons Canadians should engage once more in growth at all costs. Some are reminding the Big Banks of their loss in rankings, some are pointing out that with the strong Canadian dollar, almost any acquisition is price-sensible and should be considered, and still others are trying to egg on the banks by making a case that without a global footprint, they just can't compete.

These were not the right reasons to buy in 1998 and these are still not the right reasons to buy in 2008.

In the current market, it is imperative that Canadian bankers resist the drumbeats of market makers promoting the acquisition of relatively cheap U.S. financial institutions while maintaining a second prong initiative to include the banks and emerging technologies of other countries in their benchmarking initiatives.

We posit that Canadian bankers may gain their greatest competitive advantage by resisting the alluring temptation to acquire U.S. banking assets and rather focus on perfecting and marketing micro-expertise.

Develop, not buy.

Being the best in technology deployment, customer service standards and products sold per household remains a long-term shareholder value building strategy regardless of the deeply discounted bargains to be south of Niagara Falls.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Make informed decisions in a digital financial world