Overview

August 2008

Boston, MA

Retail Credit Cards: New Interest In An Old Topic

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the venerable world of private label and co-branded retailer credit cards, and the market forces that are shaping this segment. The vast majority of retailers have turned their programs over to third party issuers, but these retailers' interest in payments as a sales enabler and relationship building tools have never been higher. And with more payment vehicles and providers at their disposal, retailers increasingly focus on developing their optimal payments strategy.

Highlights of the report include:

- Private label credit card programs owned and managed by retailers continue to dwindle in number.

- Third party retail portfolio purchasers continue to grow, but contract renegotiations and renewals may alter the competitive landscape.

- In-store competition among merchant-sponsored payment vehicles is intensifying, as merchants deploy co-branded, private label, decouple debit.

- Emerging payment providers may be creating the next generation of networks and applications for retail, posing a competitive risk to traditional private label programs.

- The promise of credit for all is as enticing as it ever has been, and retailers and lenders are responding by designing products designed to evaluate consumer's risk in a way that supports their funding any purchase from that merchant; whether it is through a co-branded credit card, proprietary card or at the transaction level.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group, and one of the report's authors comments, "to the consumer, the private label world is alive and well and in some ways, better than ever. To the retailer, their branded accounts can now be part of a layered payments strategy designed to maximize consumer purchasing opportunities. To the issuer, the general purpose versus proprietary card war is over and the market has found some degree of balance. As the smoke clears, consumers still want access to easy credit and retailers still want to increase spend. In-store credit was born out of this simple need, so while the economic pie may be sliced up differently, roles have changed, and new players have come on board, this is the core need to be addressed."

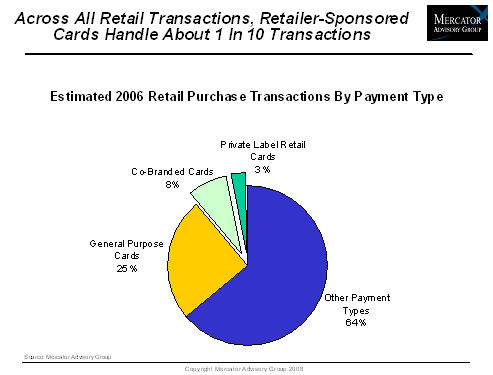

One of the 6 Exhibits included in this report.

The report is 32 pages long and contains 6 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to: [email protected]

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world