Overview

Revitalizing Core Deposits: Deploying New Strategies to Rebuild the Heart of Banking

Boston, MA. - December 23, 2009 -- While tough news has battered the banking industry as 133 banks have failed already in 2009, another 400 are in the I.C.U. and industry executive compensation is growing profoundly rich, again, not all news has been grim. Even within a challenging economic climate, core deposits have continued to grow, increasing from $4.1 trillion in 2002 to $6.5 trillion, Q3 2009. Despite buffeting news and a tough economy, banks continue to intermediate core deposits.

The newest report from Mercator Advisory Group's Customer-Centric Delivery Channels Practice, Revitalizing Core Deposits: Deploying New Strategies to Rebuild the Heart of Banking, profiles some of banks' impressive successes harnessing and leveraging specific delivery channels and products to attract and nurture long-term core deposit relationships.

By switching core deposit marketing and messaging away from interest rates to account features and how those features can help an individual or household achieve a specific goal, banks can dramatically erode the underpinnings of rate shopping and account churn.

Many of the most exciting core deposit products entering the market are long-term plays that lock-in deposits for years yet through monthly automatic transfers of funds into the account, keep the customer engaged with the institution, and receptive to additional marketing messages.

"By introducing merchant discounts, rewards and loyalty schemes and even long-term investing bonuses into the mix of features offered in the design and marketing of banking deposits, the days when the banking industry offers a safe yet above-inflation return on deposited funds may well lie ahead of us," comments Elizabeth Rowe, Director of Mercator Advisory Group's Banking Advisory Service and author of the report. "Seeing banks designing core deposit products that create a long-term savings structure for their customers while they hone the cross-sell strategies for those relationships makes us think this may finally be the time for banks to move aggressively into products for rainy-day and retirement savings. After 40 years of losing customer deposits to brokerage accounts, that tide may finally be turning."

Report Highlights Include:

The future of core deposit growth is in the migration of new rewards and loyalty schemes from the retail and payments industries into traditional DDA and savings products.

The critical issue for retail banks is that even if an institution can gain consumer mindshare and access to his/her deposits, how then does it capture the greatest possible share of wallet while managing those deposits through channels that are both lowest-cost to itself and of greatest value to the customer?

By affixing cash-back rewards and merchant funded discounts to new products, banks can rein in their CD marketing campaigns while, in the case of 529 plans, capturing growing deposits for almost two decades.

Long-term core deposits can be gathered by inserting savings products into the retirement product offerings of customers' institutional 410(k) platforms.

Core deposit growth strategies are additive. These initiatives exist on a service/technology continuum that pulls rote transactions out of the branch which both lowers the channel fulfillment costs for an institution and raises the levels customer convenience and satisfaction.

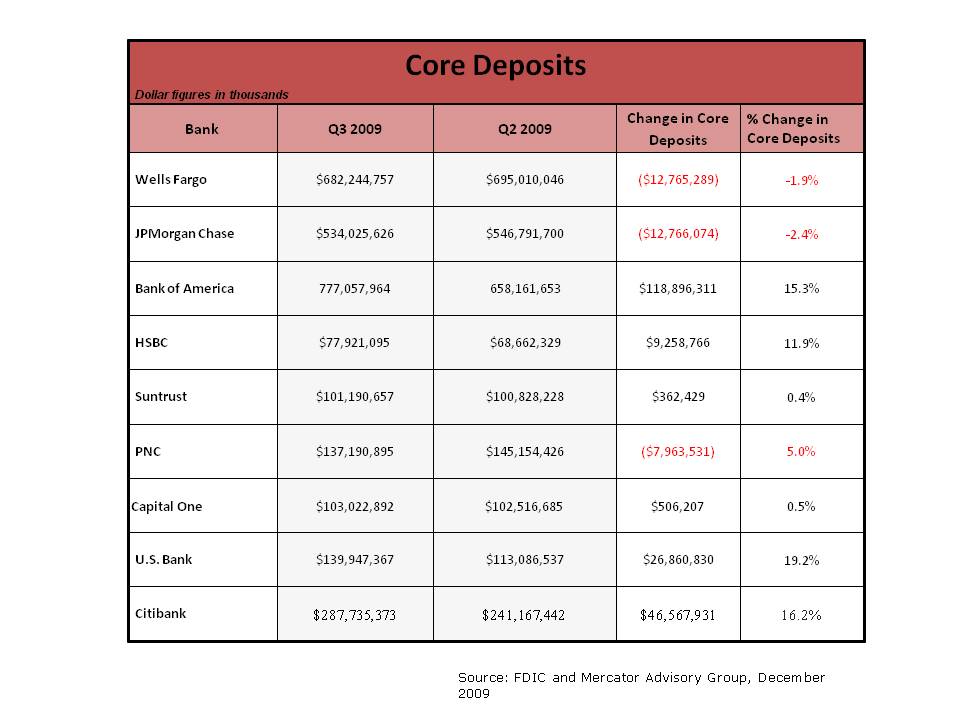

One of the 6 Exhibits included in this report:

Companies Mentioned in This Report: Bank of America, Bank of Texas, Bank of the Wichitas, Capital One, Citibank, Citizens Financial Group, Diebold, Futuretrust, JPMorgan Chase, McCombs Enterprises, NCR, SmartyPig, SunTrust, U.S. Bank, uPromise, USAA, Wachovia, Waterfiled Financial Services, Wells Fargo and WestBank

This report contains 25 pages and 6 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to info@mercatoradvisorygroup.com.

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world???s largest banks, payment issuers, acquirers and processors to the leading technology providers.

Learn More About This Report & Javelin

Make informed decisions in a digital financial world