Overview

Unbanked and underbanked consumers, many of whom have modest incomes, face numerous financial challenges. In recent years, product development designed to serve these individuals has almost exclusively leveraged prepaid accounts. Meanwhile, consumers have become much more aware of the importance of building and maintaining a good credit score—a goal not typically achieved with prepaid products. Regulatory and profitability challenges have caused some providers of secured credit cards to leave the market, although a few national financial institutions as well as several smaller ones are finding ways to make their products successful. Opportunity awaits issuers that are willing to reevaluate this underdeveloped product. Millions of consumers—young adults, recent immigrants, and consumers with past financial difficulties—are in need of credit building tools.

Mercator Advisory Group’s research report, Secured Credit Cards: An Alternative Path to Mainstream Card Products, examines the competitive landscape for secured credit cards, reviewing emerging products’ features and positioning.

“Secured credit cards are a valuable tool for consumers to build or rebuild credit,” comments Michael Misasi, senior analyst at Mercator Advisory Group and one of the report’s authors. “Financial institutions should not overlook the opportunity to establish long-term relationships with secured credit products.”

This report contains 19 pages and 5 exhibits.

Companies mentioned in this report include: Bank of America, Capital Bank, Capital One, Digital Credit Union, First National Bank of Omaha, Fifth Third Bank, Merrick Bank, Navy Federal Credit Union, Suntrust, Synovus Bank, U.S. Bank, USAA, Wells Fargo

Members of Mercator Advisory Group’s Credit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

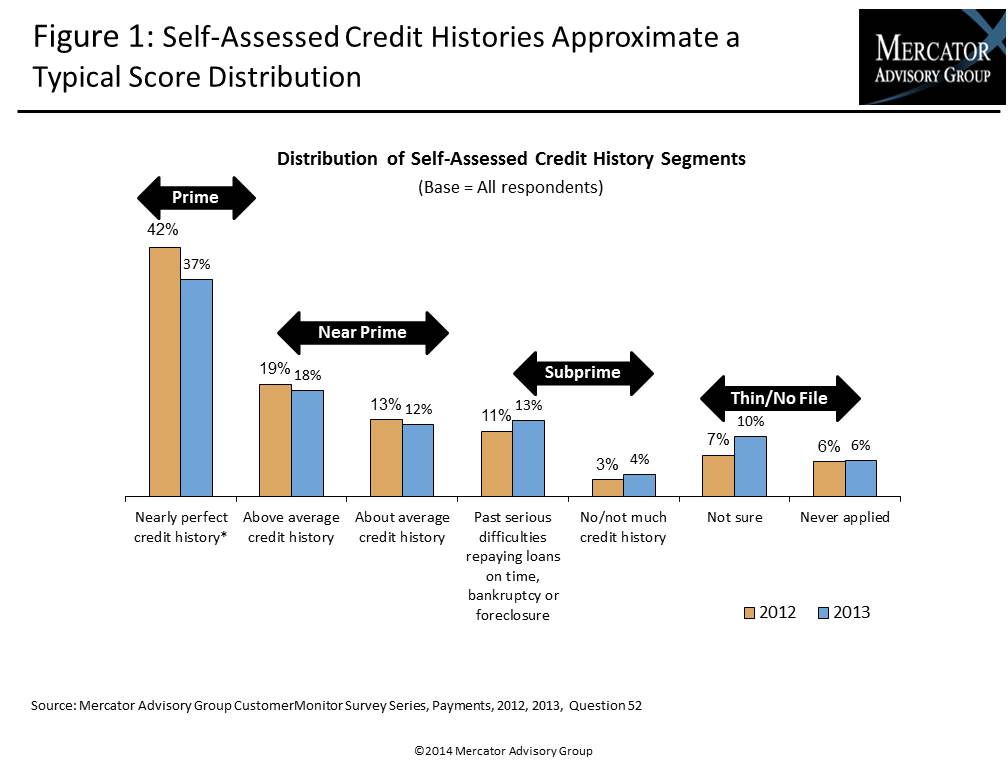

One of the exhibits included in this report:

Highlights of this research report include:

- A review of the secured card product landscape

- A discussion of the relevant target markets for secured cards, thin/no file and subprime

- Estimated addressable market (number of consumers) for various secured card market segments

- An analysis of key product trends such as upsell strategies, use of partially-secured cards, and the budgeting use case

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world