Overview

Selecting A Personal Checking Account:

Enabling Fee To Value Comparisons

Boston, MA -- With the release of the final rules governing debit card interchange, debit issuers across the country can now begin the process of analyzing the near-term impact this reduction in fee income may have on their retail banking franchises. For the first time in decades, consumers will have a new point of comparison in the form of "free vs. fee" as they consider which checking account product best meets their financial services' needs. These dynamics will have an impact on the competitive market for retail financial services and in particular, on traditional debit product issuers.

In the report, Selecting A Personal Checking Account: Enabling Fee-To-Value Comparisons, Mercator examines the impact of these market changes on retail banking products and examines the variety of communication and account comparison strategies financial institutions are using to help consumers choose the right DDA. In the new normal environment, retail deposit franchises are motivated to coordinate their account features and benefits into the most profitable mix of services that offer the best value to their target markets.

"As our recent consumer surveys indicate, consumers who are faced with paying new account, transaction, or card-based fees will shop for services. In today's vernacular, this means most consumers will begin that search online." Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service comments.

Highlights of this report include:

An analysis of the dynamics of the traditional debit issuer market and discussion of how consumers select their primary financial institution, and search for financial services.

A review of the new competitive market for retail depository services.

A discussion on the valuation of financial services.

A detailed review of six different communication strategies including examples of each.

A review of how some financial institutions are re-engineering their message for a contemporary market.

One of 18 exhibits in this report:

This report is 30 pages long and has 18 exhibits.

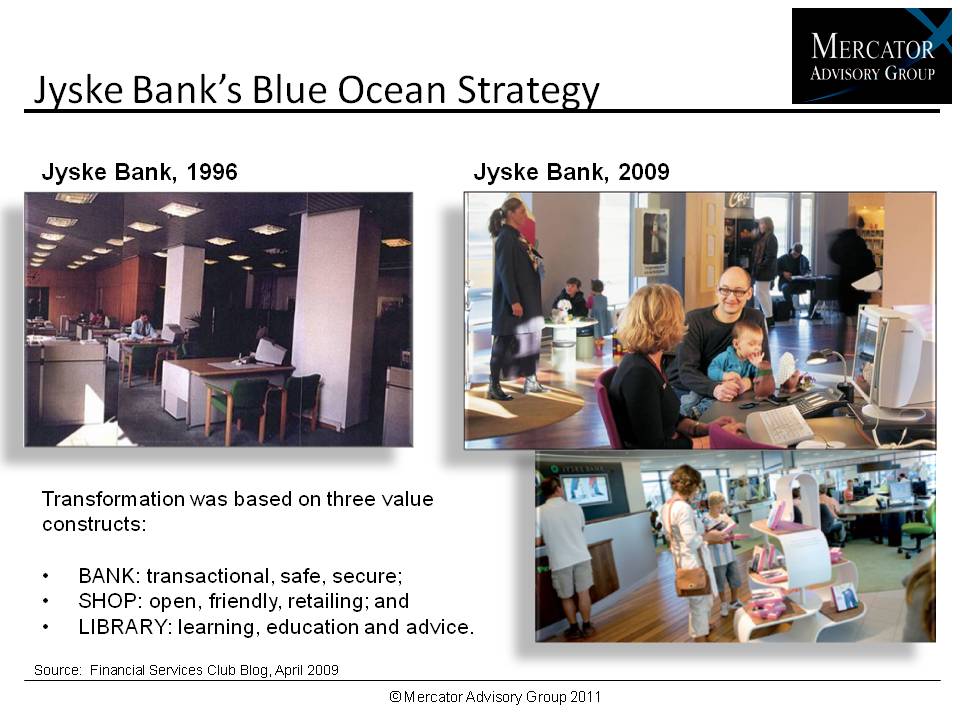

Companies mentioned in this report include: Jyske Bank, ING Direct, Fremont Bank, PNC, Wells Fargo, Washington Savings Bank, FindaBetterBank.com, TD Bank, Desert Schools FCU, Bank of New Zealand.Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world