Self-Service, ATM, and Other Channel Banking: Omnichannel Experience Needed

- Date:June 18, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

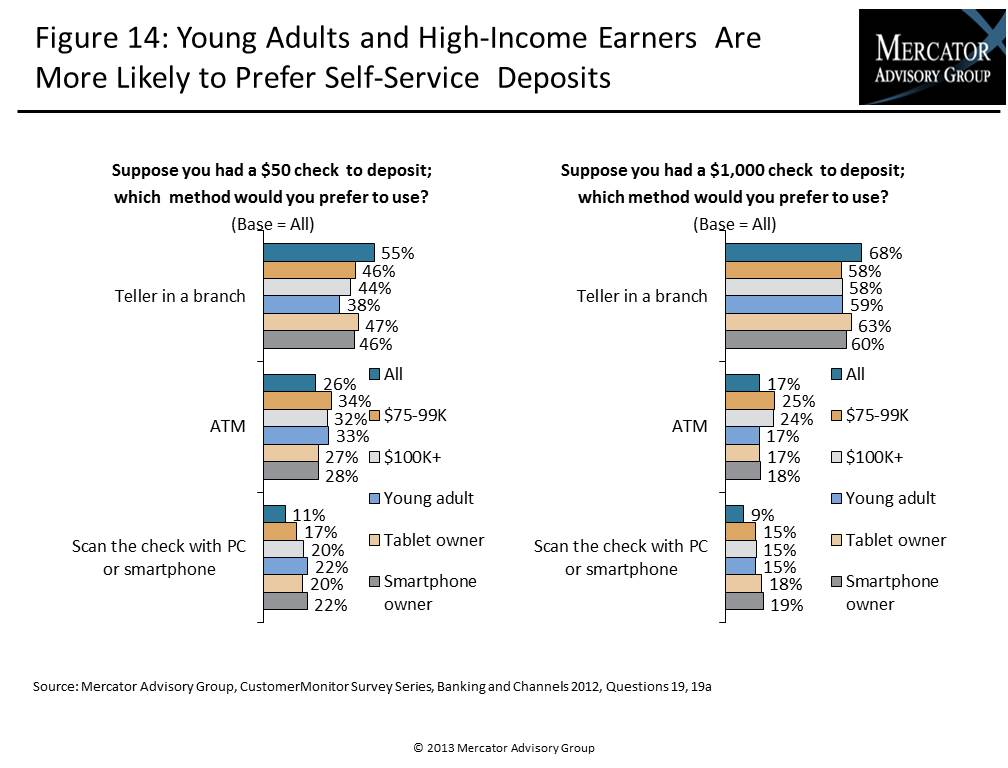

Self-Service, ATM, and Other Channel Banking: Omnichannel Experience Needed, the latest report from Mercator Advisory Group, is the last in a series of eight consumer survey reports based on late 2012 data. This research examines consumer trends in self-service banking adoption by methods for check deposits, use of self-service channels compared to traditional channels, and interest in new, self-service technologies. The study also addresses next-generation ATMs with

no-envelope deposits as well as consumers' interest in other financial services using ATMs and their interest in teller-assisted videoconferencing for banking transactions.

One of the exhibits included in this report:

The report findings are based Mercator's CustomerMonitor Survey Series. The foundation of the series is data obtained during a national sample of 1,008 online consumer survey responses completed between October 23 and November 2, 2012.

"Consumers are taking advantage of the variety of self-service banking options at their convenience with more frequent engagement using more banking channels than ever before. Consumers using multichannel banking expect more from their banks in the form of faster processing and a consistent user experience across all channels that reflects all the customer's activities performed in any channel. This seamless channel integration, an "omnichannel" experience, will require financial institutions to develop new methods and tools to support and nurture customer engagement," states

Karen Augustine, manager of CustomerMonitor Survey Series at Mercator Advisory Group and the author of the report.

Highlights of this report include:

-Year-over-year trending of U.S. adult consumer usage of self-service banking channels

-Frequency and usage of ATM deposits, envelope vs. no-envelope, cash vs. checks

-Shifts in methods of receiving cash and depositing checks

-Importance of financial services, coupons, and rewards offered at the ATM

-Trends in use and interest in videoconferencing

The report is 55 pages long and contains 25 exhibits

Learn More About This Report & Javelin

Related content

2024 North American PaymentsInsights: U.S.: Generational Consumer Payment Trends

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

2024 North American PaymentsInsights: Canada: Exhibit

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

2024 North American PaymentsInsights: U.S.: Exhibit

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

Make informed decisions in a digital financial world