Overview

Sixth Annual Closed Loop Prepaid Market Assessment

New Research Report Examines Growth and Trends of

Closed-Loop Prepaid Card Market

Boston, MA. - September 17, 2009 - - The total prepaid market, both Open Loop and Closed Loop, continues to grow, but a large part of this growth is driven by the increased adoption of Open Loop network branded cards as a replacement for checks - both government to consumer and business to consumer payments. Despite its large size, or perhaps because of it, the Closed Loop market has fallen into a rut and few investments are being made to create innovative solutions that increase the value of Closed Loop cards to both consumers and businesses.

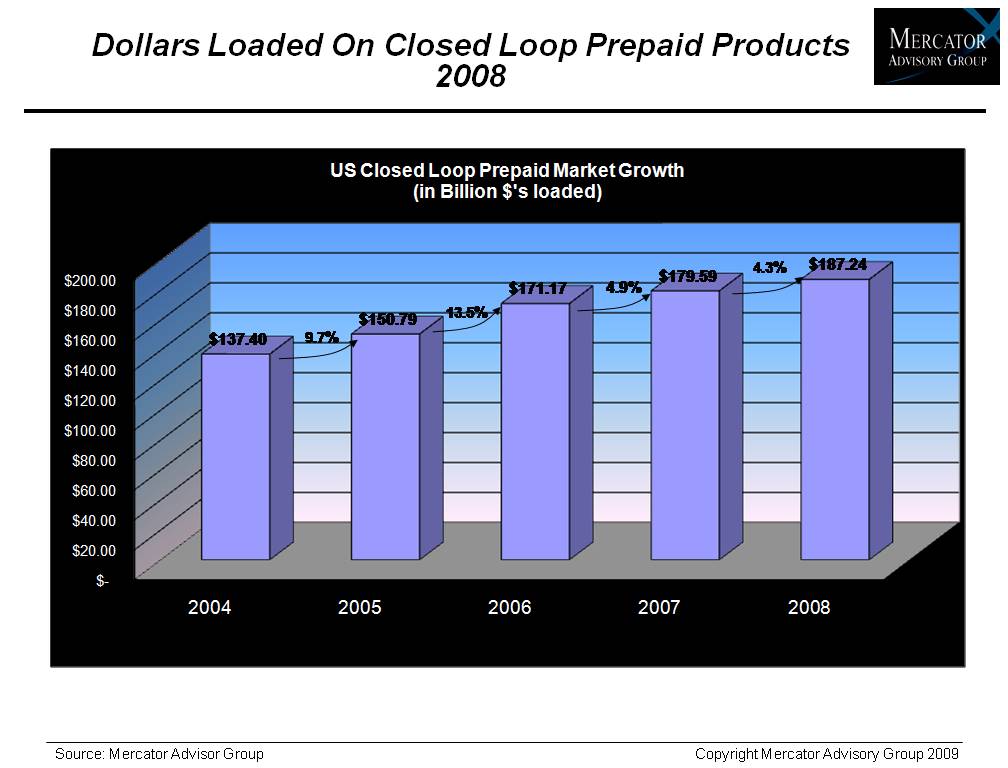

In 2008, $187.24 billion was loaded on Closed-Loop prepaid solutions, a slight increase of 4.3 percent over the 2007 load of $179.59 billion. There were several fast growing Closed Loop market segments, such as Digital Media 24 percent, Consumer Incentives (Closed Loop) at 19.3 percent and Petroleum at 23.2 percent, however these markets were simply unable to compensate for several large segments that under performed. Several underperforming Closed Loop segments in 2008 were closely associated with consumer spend that was impacted by the recession and reduced corporate spending.

The 6th Annual Closed Loop Prepaid Market Assessment is the second of our annual trilogy of closely followed prepaid benchmark reports (Open, Closed, Forecast) that provide a thorough analysis and documentation of the growth and development of the Prepaid Industry. It benchmarks the spending, growth, and market dynamics for all Closed Loop Prepaid Solutions. This includes a review of the dollars loaded on Closed Loop Prepaid products in 23 different market segments.

"While clearly the economic downturn hasn't helped investments, it has instead increased the challenges that confront program managers, and the fact remains that the majority of the Closed Loop market has become lackadaisical. Program managers have apparently accepted slow growth as the industry's fate, instead of making needed investments," Tim Sloane, Vice President of Client Services and Director of Mercator Advisory Group's Prepaid Advisory Service and author of the report comments. "Mercator Advisory Group believes that growth in Closed Loop solutions will ultimately occur, but given current lackadaisical efforts by merchants, it seems likely that growth is a long ways off and will be achieved first by a shortlist of Closed Loop innovators."

The 6th Annual Closed Loop Prepaid Market Assessment provides insights into the challenges and opportunities of the Closed Loop market and examples and discussions on how program managers and/or issuers can overcome these obstacles.

Highlights of this report include:

- The total load for all 33 Prepaid Segments in 2008 (Open & Closed) was $247.7 billion, a $27.4 billion increase over the $220.3 billion load in 2007 - an increase of 12.4 percent.

- Closed-Loop Gift Cards used for Consumer Incentives grew by 19.3 percent.

- The Digital Content Category had another great year growing to $8.04 billion for a growth of 17%. Of this Digital Media, driven by Apple and other music prepaid products, accounted for $4.71 billion for a 24% growth rate, despite a poor 2008 holiday season.

- The In Store Gift Card market segment only grew by $1.1 billion, while some specific merchant categories saw negative growth.

- While In Store sales were very slow, sales of gift cards through Third Party Distributors grew by 21 percent; the highpoint for most gift card merchants in 2008.

An exhibit in the report:

This report contains 28 pages and 16 exhibits.

Segments Covered: Business Travel, Events & Meetings, Employee & Partner Incentives, Consumer Incentives, Relocation, Campus, Digital Media, Net Phone, Games & Ringtones, In-Store Gift Cards, Distributed Gift Cards, Social Security, Food Stamps & WIC, TANF, Prisons, Transit, Benefits, Petroleum, Utilities, Prepaid Mobile Telecom, Long Distance Minutes, Home Dial Tone, Internet Access.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world