Small Business Banking: A Captive Audience

- Date:November 28, 2018

- Author(s):

- Karen Augustine

- Research Topic(s):

- Small Business PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s latest report, Small Business Banking: A Captive Audience,is the third of three Insight Summary Reports summarizing the results of the 2018 U.S. Small Business Payments and Banking Survey, a web-based survey of 2,047 U.S. small businesses (between $500,000 and $10 million annual sales), which was fielded in the spring of 2018. The previous two reports presented the survey’s findings on payment acceptance and business-to-business payments. The new report analyzes small businesses’ use of banking services and alternative lenders.

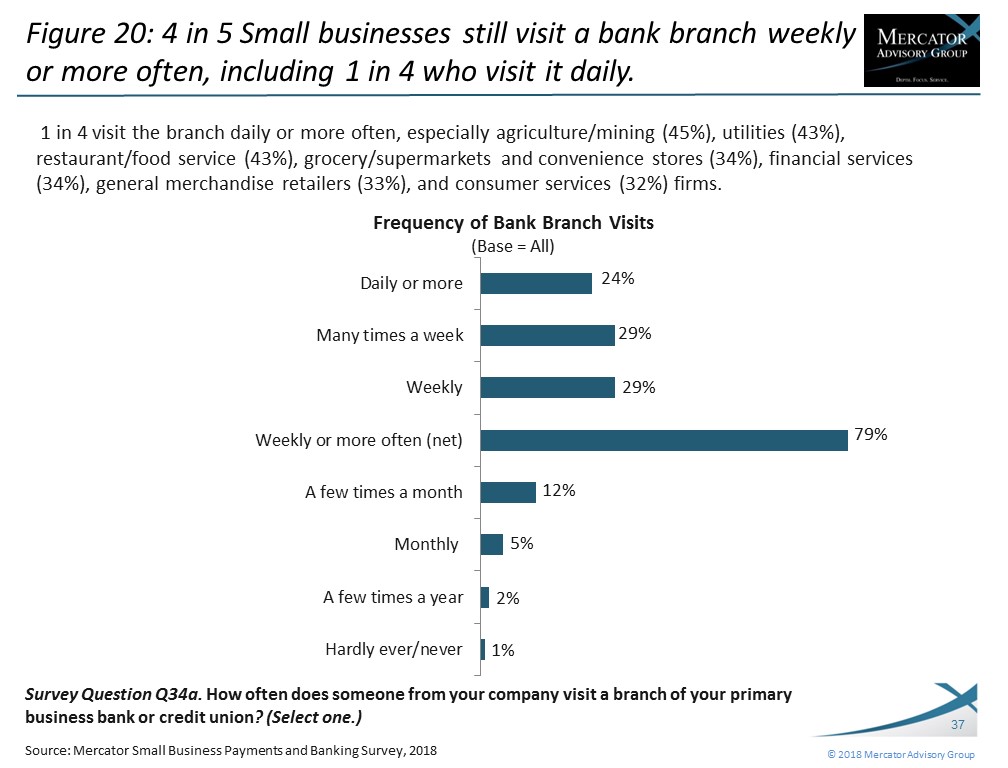

Small businesses are a captive audience for financial institutions as they still visit the branch often. The survey finds that 79% of U.S. small businesses visit the branch of their primary business bank or credit union at least once a week, including 24% of firms that visit daily or more often. Retailers and services are especially likely to visit the branch daily or more.

Small businesses rely on their business banks for a variety of services although going to the branch remains primarily transactional in nature; 72% go to the branch to make teller deposits and 38% to make ATM deposits, and more deposit cash than checks. Yet, nearly 1 in 4 go to meet with a relationship manager, often for financial advice, to resolve problems or to seek assistance for online or mobile banking.

“Small businesses visit bank branches often. While they are primarily there to make quick deposits, they are a captive audience for a wealth of services to help small businesses grow and prosper, particularly lines of credit to support investments and manage their cash flow and wealth management accounts for their personal financial health,” notes Karen Augustine, Mercator Advisory Group’s Senior Manager of Primary Data Services, the author of this report.

This report contains 53 pages in slide form and 31 exhibits.

Companies mentioned include: Kabbage, Lending Club, OnDeck Capital, and Prosper.

One of the exhibits included in this report:

Highlights of this Insight Summary Report include:

- Business checking and deposit services and transactional service used at banks, credit unions, and other providers

- Types of loans held at primary or other banks or credit unions and at other providers and largest credit line held at a financial institution

- Experience with online alternative, peer-to-peer lenders and reasons for use

- Use of merchant cash advance and working capital loans

- Use of branch, types of activities conducted at branch for deposits, ATM, advice, and support

- Use and interest in online and mobile banking capabilities

- Preference for online bill-pay

- Wealth management relationship at primary financial institution

- Satisfaction with primary business bank’s dedication to small business

Learn More About This Report & Javelin

Related content

2024 Small Business PaymentsInsights: U.S.: Exhibit

Small businesses make up the largest segment of businesses in the U.S. economy. Understanding the types of payments these businesses accept and the vendors that enable these servic...

2024 Small Business PaymentsInsights: U.S.: Payment Acceptance Services & Card Payment Processing

Small businesses make up the largest segment of businesses in the U.S. economy. Understanding the types of payments these businesses accept and the vendors that enable these servic...

2024 Small Business PaymentsInsights: U.S.: Small Business Technology Attitudes

How a small business approaches its business and technology initiatives will set the tone for the types of vendors and solutions it must incorporate into its broader strategy. Smal...

Make informed decisions in a digital financial world