Overview

Boston, MA

October 2007

Small Business Credit Card 2007 Update: Competition for Segments Intensifies

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

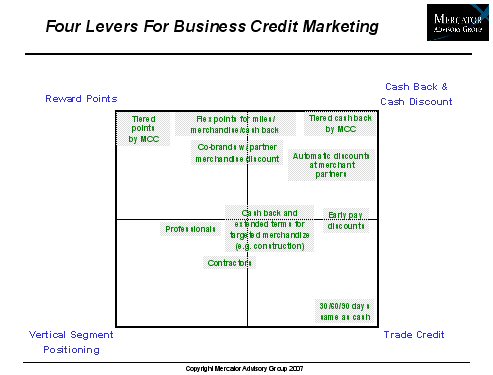

This report examines recent developments in the highly competitive small business credit card marketplace. Small business credit, charge, and debit purchase volume is approaching an estimated $300 billion annually in the U.S., and the market offers the potential for above-average growth for issuers targeting the segment. In this desirable segment, intensified competition for small businesses is emerging on four fronts:

- Reward points programs

- Cash back and discounts

- Trade credit offers

- Vertical segment positioning

The potential combination among these four dimensions are nearly unlimited. Credit card issuers and other lenders may use them to offer segmented offerings to capture the attention of small businesses and engage them in using the product.

Highlights of the report include:

- The small business credit card market continues to offer above average growth opportunities to issuers.

- The complex segment structure of the small business universe is spawning segment-oriented products, with more such offerings to come.

- The value of trade credit to cash-flow-affected small businesses is significant, and lenders are increasingly offering trade terms in their programs.

- Future marketing directions are likely to pursue narrower segment interests, as well as offering user-selected trade terms.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report comments that, "there are some key product developments in the industry that may well cause small businesses and lenders to re-discover credit terms, and in particular business-oriented trade credit that is not just a re-packaged consumer offering. Trade credit terms in various incarnations are becoming available through small business programs, and may well make an impact on future product directions."

One of the 16 Exhibits included in this report:

The report is 29 pages long and contains 16 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world