Overview

Small Business Credit Card 2010 Update:

Dare We Call The Bottom?

New Research Examines Developments in Competitive

Small Business Credit Card Marketplace

Boston, MA -- The small business credit card segment may be finally nearing its decline, at least in terms of card spending volume.

In spite of the economy's ongoing disruptions this year, issuers of these products have been developing initiatives in the areas of:

- Branch-based marketing

- Adding value for small business cardholders through social media and value added services

- New and revived charge (non-revolving) cards

"As issuers return cautiously to marketing mode, they are trying to maximize their appeal to equally cautious business owners. Card-based spending appears to be picking up modestly due to improving business activity, but demand for card-based credit has yet to recover. Business owners are primarily focused on cash flow management and maintain a pay-now orientation," comments Ken Paterson, director of the Credit Advisory Service and primary author of the report.

Highlights of this report include:

-

The small business credit card market declined in 2009 as businesses cut back spending.

-

The small business credit segment will enjoy minor increases in spending volume for the industry for 2010.

-

On balance, while credit conditions are still tight, lack of credit demand by small businesses appears to be the main factors holding down credit expansion. Most businesses are avoiding borrowing.

-

While avoiding major regulatory interventions in 2010, the segment is not immune to scrutiny, especially regarding marketing practices, disclosures, and the definition of eligible businesses.

- 2011 looks like a modest growth year for small business cards in terms of spending, while credit outstanding continues to decline, primarily due to lack of demand.

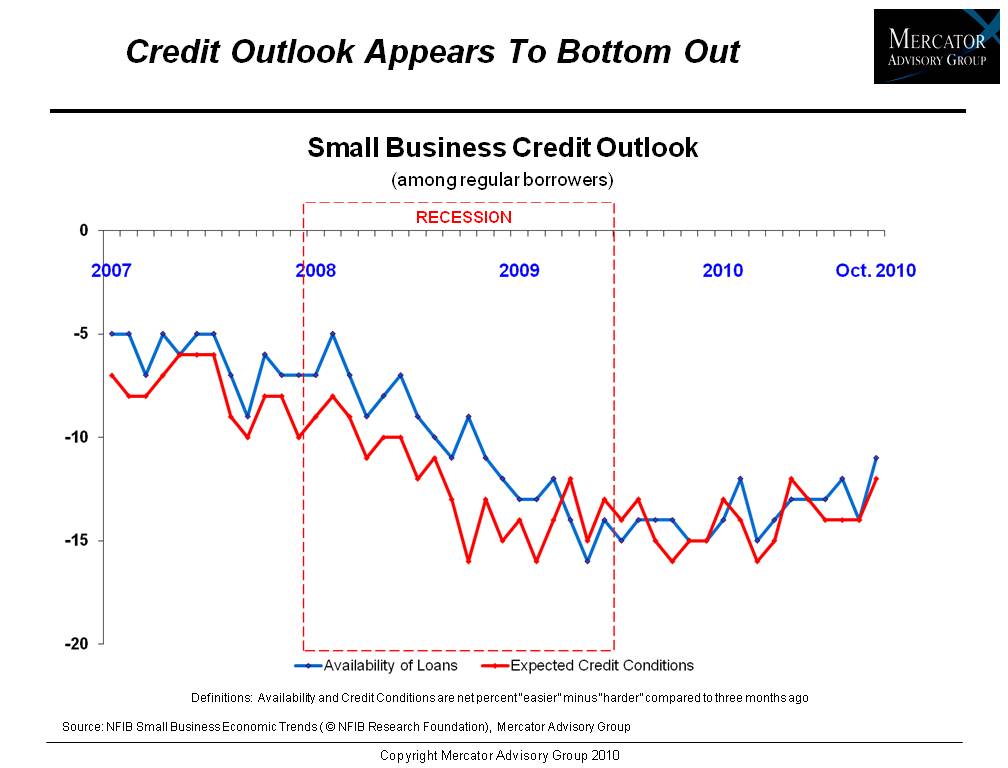

One of the 7 exhibits included in this report:

This report contains 26 pages and 7 exhibits.

Companies covered in this report include: American Express, Chase, Discover, MasterCard, Visa.

Members of Mercator Advisory Group have access to this report as well as upcoming research for the year, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world