Overview

Small Business Debit: How Small is Small?

Boston, MA - A combination of small business market growth and tighter lending policies has resulted in creating a strong opportunity market for small business debit issuers. However, as with any market, size matters and up until recent years as issuers focused on the run up to building the consumer debit card market, small businesses, and in particular, very small businesses were often an also-ran strategy. In addition, the lack of clarity around small business debit in the EFTA definition of a debit card transaction found in the Durbin Amendment will almost certainly give some issuers pause as they consider their product investment budgets.

Nevertheless, small business products and services may offer some protection from the vagaries of regulatory reform as this market has the potential for sustainable growth opportunities in a mature debit card market and also comes with the expectation that businesses pay fees for their financial services.

Mercator Advisory Group's report Small Business Debit: How Small is Small? Examines the small business debit market in the light of the "new normal" for issuers considering how best to expand their debit card portfolios including best practices, network solutions, and opportunity market analysis.

"Whether an issuer approaches one, two or all three segments of the small business market, small isn't small anymore. In an issuing market where there is more supply than demand, addressing a debit card segment that has the potential to deliver millions of new accountholders spending billions of dollars each year has not gone unnoticed by issuers or card networks," Patricia Hewitt, Director of Mercator Advisory Group's Debit Advisory Service comments.

Highlights of this report include:

An examination of the current market dynamics that surround the small business debit market.

An analysis of small business segments and review of card network solutions.

A discussion of go-to-market issuer strategies.

A review of the potential impact of regulatory changes on the small business debit market.

An estimate of the cardable opportunity pool available to issuers for business debit products.

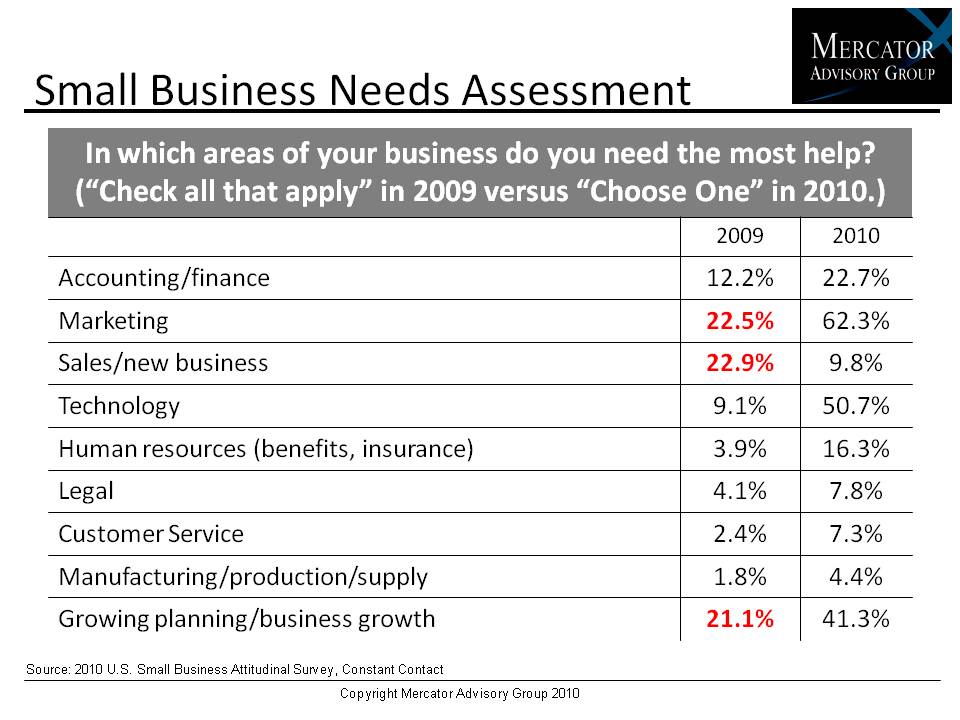

One of 15 exhibits in this report:

This report is 29 pages long and has 15 exhibits.

Companies mentioned in this report include: TD Bank, Fifth Third Bank, PNC Bank, Visa, MasterCard, American Express.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world