Overview

Payments Orchestration and the Benefits of Smart Terminals for Merchants

Mercator Advisory Group’s most recent report, Smart Point-of-Sale Terminals: A Rapid Transformation of Payments Acceptance provides insight into this exciting new technology, and what every merchant needs to know about it.

‘Smart terminals’ is a relatively new term in the payments lexicon, but one that is becoming more widely discussed among merchants of all sizes, types, and categories. The strategy that drives orchestration is nothing less than a paradigm shift in the way that merchants view payment service providers. Rather than conduct due diligence to select a “best-of-breed” service provider for each functional area within payments, orchestration allows merchants of all sizes and scales to offer their customers a smooth shopping experience, be it digital, in-person, or other channels. The growing diversity in payment methods, including contactless and e-wallets, creates an environment where having the right partner is paramount towards achieving your payments and overall business goals. The right payments partner will equip a merchant with the necessary capabilities to operate in this rapidly digitizing business environment, where automation and frictionless experiences are vital in ensuring customer satisfaction and loyalty. Similarly, in order to help merchants provide these services, processors and other payments stakeholders must update their own services and products to keep up with the latest demands of the consumer market and regulatory requirements.

“This is a highly relevant and impactful report,” stated the author of the report, Shreyas Shaktikumar, Senior Analyst in the Merchant Services and Acquiring practice at Mercator Advisory Group. “We are following the smart terminals trend among a number of similar technology trends that are making payments a frictionless and invisible part of our everyday activities.”

This report is 19 pages long and contains 9 exhibits.

Companies mentioned in this report include: Diebold Nixdorf, Fiserv, Ingenico, JPMorgan Chase, Micros, NCR, PayPal, POPcodes, Revel, Shopify, ShopKeep, Stripe, Square, Verifone, WePay, Zettle.

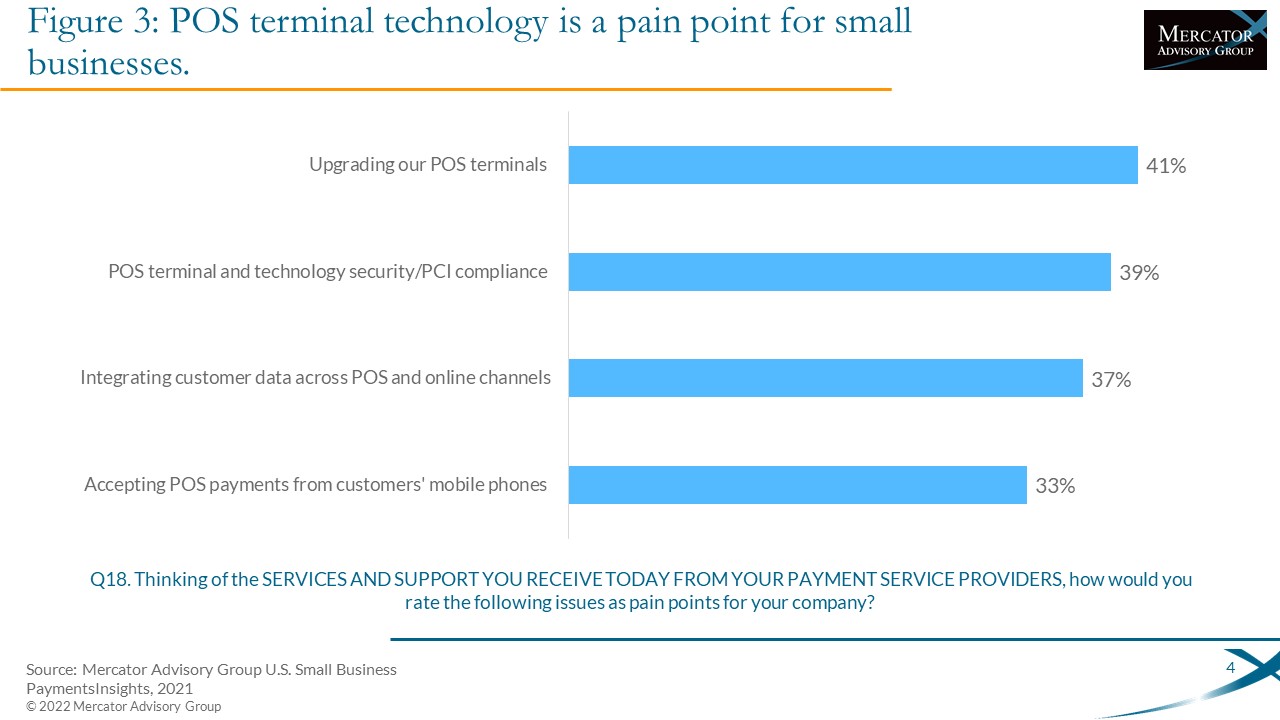

One of the exhibits included in this document:

Highlights of this document include:

- Identification of a set of core functionalities representative of a modern smart POS terminal infrastructure

- Outline of the use case for smart terminals including identification of four pain points that are directly addressable through the adoption of modern POS terminals

- Market trends

- Market leaders

- Recommendations for merchants

- Recommendations for processors

Learn More About This Report & Javelin

Related content

Surcharging on Card Transactions: In Search of Balance

The decision by a merchant to impose a surcharge on credit card transactions—usually a percentage of the purchase price to offset the cost of card acceptance—is understandable but ...

Payment Orchestration: Making the Juice Worth the Squeeze

Payment orchestration has come to the forefront as enterprise merchants work to squeeze the most from their payment platform. In addition to optimizing authorization rates, merchan...

Implementing Pay-By-Bank: A Guide for Merchants

Many merchants are exploring alternative ways to accept payments from customers and reduce the rising cost of accepting card payments, but is the U.S. banking infrastructure ready ...

Make informed decisions in a digital financial world