Overview

Boston, MA

December 2008

Social Networking is the New Community Banking:

When Will Banks Stake a Claim in Emerging Online Financial Communities?

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The latest report from Mercator Advisory Group's Retail Banking Practice offers examples of new players in the financial services social networking space and provides commentary on their strategies that are working or that could work with the inclusion of additional functionality.

In the past two years, a wide variety of social media/networking sites have appeared across the Internet and have been enthusiastically embraced by Web denizens representing a wide range of financial interests. Savers, bill payers, first time home buyers, new families, traumatized investors who refer to their "104-(k)s" and even consumers still interested in buying a boat, a car, or a credit card are all flocking to personal finance social networking sites seeking advice, comradery and community.

While there are dozens of Web 2.0 sites financed by deep Silicon Valley pockets, banks have been slow to integrate their multiple mandates for technology investments (security, profitability, new account acquisitions, cross-sales) in an economic environment in which every bank investment is scrutinized as a taxpayer financed initiative.

It is imperative that banks and credit unions make emboldened efforts to involve themselves and their customers (and prospective customers) in emerging social networking communities. By the time these technologies, their features and capabilities are well enough understood for even the most cautious compliance officer's comfort, the window of opportunity to become a relevant destination for social networkers will be gone.

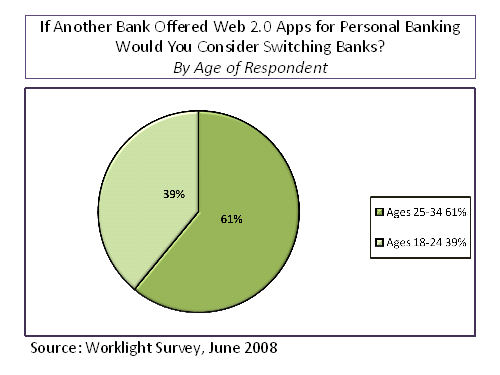

One of the 12 Exhibits included in this report.

Report Highlights:

- Fifty percent of online 18-34 olds are interested in conducting personal banking through social networking sites and a solid quarter of that group willing to change banks to manage their personal finances using these new Internet tools.

- Banks are pursuing a rich target of consumers planning on working (and banking) indefinitely. An April 2008 survey found that more than two-thirds of Americans aged 27 to 42 do not think they will ever be able to stop working.

- Even younger Americans are highly motivated to save for both a rainy day and for retirement. A recent survey found that 89% of 18-24 year olds plan to save for retirement in 2009.

- With more issuers entering the prepaid market and card abandonment becoming the bane of the industry, efforts to build loyalty and community and repeat brand exposure may well be a critical differentiator for those card programs that thrive in the reloadable space.

- Few banks have mastered their professional banking offerings. Offering dedicated financial services to the professional segments - doctors, lawyers, accountants, engineers and architects is potentially very profitable to banks and social networking overlain over a truly business specific set of credit and account offerings has the potential to make an institution a true standout among its peers.

Companies Mentioned in this Report:

- Australia New Zealand Banking Group

- Bank of America's Small Business Online Community

- Charles Schwab

- Edo Interactive's Facecard

- Fiserv's My Money

- ING Direct

- RaboBank Australia's Executive Blog

- SmartyPig

- Twitpay

- Visa's Business Network

- Wells Fargo's Stagecoach Island

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and one of the principal analysts of this report, comments, "Many socially networking customers will disintermediate their assets and credit from traditional brick and mortar banks and will follow them to their new communities. As consumer networkers build larger and more dynamic communities, the venture capitalists financing those sites will ramp up their marketing efforts in a bid to monetize the sites by collecting deposits and facilitating ecommerce and P2P money transfers.

Bankers who tarry, risk their place at the fiduciary table. With half of the key Gen-Y demographic cohort keenly interested in conducting personal banking through these sites and a solid quarter of the group willing to change banks to manage their personal finances through these new Internet tools, it is clearly time for banks to explore products, channels and Web 2.0 advances.

Online communities are developing along increasingly segmented lines - by cohorts of Facebook friends, by life stages, by small business start-up phases of development and by professional niches. Those institutions that are standing on the side lines are missing out on the ability to create real dialogue with their customers (cutting both ways - in Web 2.0, if a bank wants to talk to a customer, it has to be willing to listen to what that customer has to say back) and to market specific services and products to customers on a just-in-time basis keyed to real-life experiences and demands. In addition to creating more relevant and differentiated products and services based on new insights, marketers are also discovering that truly listening deepens customer loyalty."

The report is 27 pages long and contains 12 exhibits

Other recent research from the Retail Banking Advisory Service:

| Big Bank Mergers, the Payments Industry and the Dark, Dire Economy | | ||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Learn More About This Report & Javelin

Make informed decisions in a digital financial world