Overview

Boston, MA

April 2007

Solving the Micropayment Problem: Online and at the POS

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

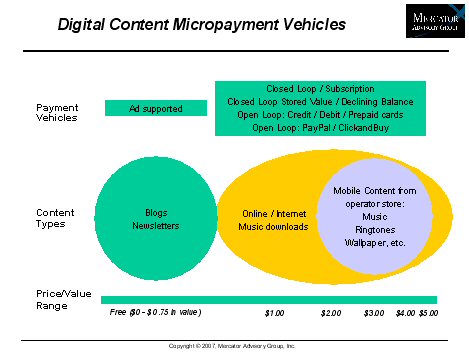

Mercator Advisory Group is pleased to announce that its review of its latest report, Solving the Micropayment Problem, Online and at the Point of Sale. The report reviews both the history and challenges of electronic micropayments and examines how the existing rails have evolved to address under $5 electronic payments at both the point of sale and for online transactions.

In particular, the report examines the evolution of multiple micropayment models and how they have shifted the economics of micropayments, especially online. The ad-supported revenue model, powered by Google AdWords and other sponsored advertising sources, has significantly altered the need for a ubiquitous online "coin purse" for digital products below $0.75 in value. At the point of sale, micropayments have been successfully addressed by lower interchange rates for selected merchant categories and, in some markets, by contactless payments.

The Solving the Micropayment Problem report includes a review of market participants including PayPal, BSG Clearing Solutions, ClickandBuy, PaymentOne, and Peppercoin/Chockstone.

Highlights of the report include:

- Online micropayments has been an unkind market segment for payment processors aggregating multiple small transactions as a pureplay processing service.

- The early Internet dream of nearly frictionless purchases of sub $0.75 content has been made irrelevant by free content and the ad-supported revenue growth that powers the best free content sites as well as the growth of search giant Google.

- Online, it is per transaction charges, not interchange, that eats up excessive margin for sub $1.50 digital content.

- Given lower interchange rates for low-risk, high volume merchant categories such as QSRs, transit, parking and others where micropayments are common, barriers have dropped for the electronification of under $5 payments.

- The markets for micropayments at the POS overlap with those for contactless payments.

"Under $5 micropayments online have been a persistent source of pain for content creators and distributors," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "Evolution of payment models such as ad-supported content creation and distribution have largely erased that pain. Coupled with subscriptions and payment aggregation, the online picture is clearer but still requires better solutions. Ironically, electronic micropayments work better at the POS than they do online."

One of the seven Exhibits included in this report.

This report is 23 pages long and contains 7 exhibits, 5 tables and a Glossary of Terms.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world