Overview

Closed-Loop Load Growth Slows, but the Market Continues Forward

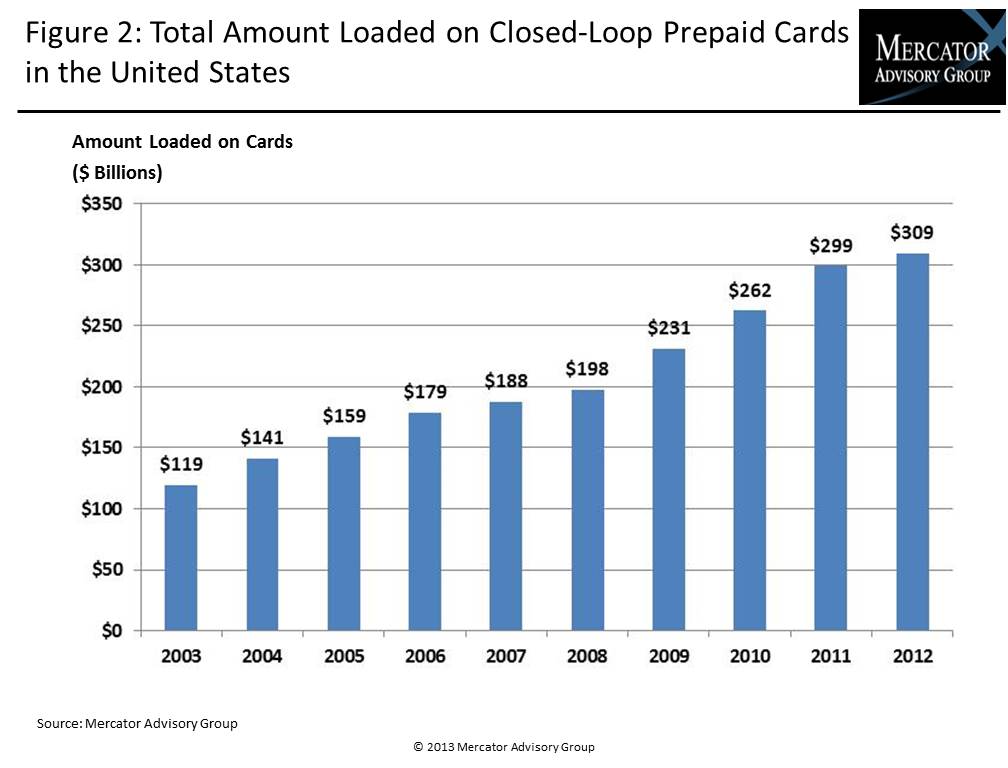

The closed-loop prepaid market, which consists of 17 segments, grew to $309.1 billion in 2012, up 3 percent from $299.1 billion in 2011. This report documents the dollars loaded onto closed-loop prepaid cards or access devices in the United States during 2012. Mercator Advisory Group was able to gather more data this year than in previous years, so the report presents an even clearer picture of the market.

Mercator Advisory Group defines a closed-loop card as one that can be redeemed only at the issuer's designated locations. Examples include a retailer's card that can be used only at the retailer's own stores or a government benefit cards that can be used only at select retailers that are linked into the government's electronic benefits transfer (EBT) network

"Growth in the closed-loop prepaid market has slowed, but the Digital Content and Games & Ring Tones segments continue to grow at a rapid pace as more people choose to download songs, games, books, and other content from the Internet," says Ben Jackson, Senior Analyst in Mercator's Prepaid Advisory Service and author of the report.

The 10th Annual U.S. Closed-Loop Prepaid Market Assessment report is the second of Mercator Advisory Group's annual trilogy of closely followed prepaid benchmark reports (Open-Loop, Closed-Loop, and Prepaid Market Forecast) that provide a thorough analysis and documentation of the growth and development of the Prepaid Industry in the United States. It benchmarks the load, growth, and market dynamics for all Closed-Loop Prepaid solutions. This includes a review of the dollars loaded on Closed-Loop Prepaid products in 17 different market segments.

This report contains 26 pages and 19 exhibits.

Companies mentioned in this report include: Amazon, Boost Mobile, Facebook, Gift Card Partners Inc., Netflix, Retail Gift Card Association, Sprint, Tracfone, Vantiv, Verizon

One of the exhibits included in this report:

- The total closed-loop prepaid market grew at a slower rate in 2012 than in 2011.

- Declines occurred in Employee/Partner Incentives, Consumer Incentives, Petroleum, Utilities, and Prepaid Long Distance segments.

- Declines in the Petroleum and Utilities segments may reflect lower energy costs in 2012 compared with 2011.

- The decline in the prepaid Long Distance segment reflects of the societal trend away from landlines toward cellular phones.

- The fastest growing segments were Digital Content and Games & Ring Tones.

- The In-Store Gift and Nutritional Assistance segments continued to be the largest segments.

Learn More About This Report & Javelin

Related content

Payments in the Arena: Prepaid Can Move Into the Starting Lineup as Cash Gets Cut

Sports and entertainment thrive on fan loyalty but have yet to translate that dedication into long-term, connected share of wallet once fans are inside the turnstiles. Prepaid stor...

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

Make informed decisions in a digital financial world