Overview

Boston, MA

April 2008

Testing Merchant Acceptance of Prepaid Online: Have Gift Card, Will Lift

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

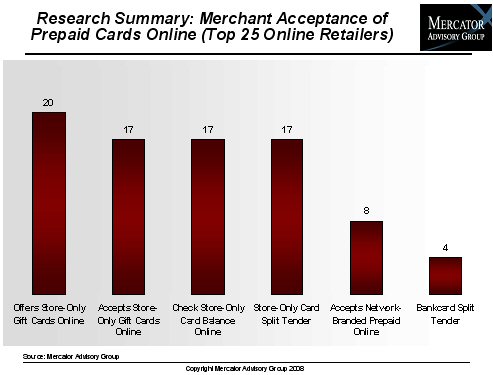

In this report, Mercator looks at the viability of the online channel for prepaid gift card acceptance and the assorted challenges associated with enabling acceptance of anonymous payment instruments in a card-not-present environment. We present the results of primary research studying the prepaid card acceptance practices of the top 25 online merchants for both closed-loop, store-only gift cards and network-branded gift cards. We also examine the context in which the issue of acceptance of prepaid online exists, and the potential impact if a revolution in e-merchant prepaid acceptance were to take place in the near term. We present estimates of the annual dollar volume generated by prepaid e-commerce and include projections forward to 2010 for two scenarios; one, in which the current infrastructure is not modified to increase prepaid acceptance online, and a second, in which the opportunity currently being disregarded by e-retailers and service providers is illuminated.

One of the 13 Exhibits included in this report:

The report is 27 pages long and contains 13 exhibits

Report Highlights:

- Mercator's primary research studied the prepaid card acceptance capabilities of the top 25 online retailers. While 68% of those studied take payments online using closed-loop gift cards, only 32% accept anonymous, network-branded prepaid gift cards.

- The anonymity of the e-commerce consumer creates an inherent risk - does that anonymity inherent in prepaid add a dimension of risk to the online merchant? Or does it matter as long as the prepaid card has been legitimately funded?

- Eight merchant case studies are presented as illustrations of how current e-commerce infrastructure is standing in the way of prepaid card usage.

- A rich context for the nexus of prepaid and e-commerce is provided, examining market trends for each space and offering forecasts to 2010 for payment volume and market opportunities.

- The main challenge to prepaid card acceptance online is the merchant's capability to accept split tender transactions using both closed-loop and network-branded prepaid cards.

David Fish, Senior Analyst in Mercator Advisory Group's Prepaid Advisory Service and principal analyst on the report, comments, "The challenges to e-merchant prepaid card acceptance are various and many according to our recent primary research. Acquirers, payment gateway providers, and merchants alike can begin to tap the enormous potential of the growing prepaid market by enabling broader acceptance of closed-loop gift cards and especially network-branded prepaid gift cards in the online space. Merchants will be able to take advantage of the much desired lift in revenue that gift cards can afford, and increasing e-commerce volume due to broader prepaid acceptance will provide a lift in fee-based revenue for service providers as well."

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world