Overview

NEW RESEARCH PROVIDES GUIDANCE ON ENTERPRISE TEXT MESSAGING IN COLLECTIONS

Text Messaging and Collections:

Driving ResponseRates 160 Bytes at a Time

Boston, MA. - May 26, 2009 -- With delinquencies at an all time high and credit card chargeoff rates exceeding 6%, the role of Collections has moved from standard business function to critical driver of profitability. But Collections is both an expensive and a delicate process. Live operator calls cost $4 and more. How the creditor communications with the debtor also impacts Collections performance.

In a new report, Text Messaging and Collections: Driving Response Rates 160 Bytes at a Time, Mercator Advisory Group explores the impact of the spread of text messaging on business-to-consumer communications through the lens of Collections. Against the background of mobile's spread and exploding text messaging volumes, B2C text messaging has expanded from mobile marketing into financial functions from corporate treasury payment approvals to Collections. The report examines text messaging's role and its key attributes of timeliness and situational relevance as generators of what appear to be a disproportionately positive impact on Collections performance.

"Text messaging has grown from Teen addiction into a national communications staple. As a new channel for business-to-consumer customers, text messaging complements and reinforces what we're already using to reach accountholders. Reaching delinquent accountholders via text is showing solid results," George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service and principal analyst on the report. "The accelerating effect on consumers of text messaging when used in combination with automated voice messaging and interactive voice response units, never mind traditional media, affirms this new channel's unique value."

Highlights of the report include:

- The mobile channel reaches more people than ever. According to the CDC, the population covered by landline telephones has fallen below 1970 levels. One in 4 adults between 18 and 34 live in mobile phone-only households.

- Text messaging isn't just for teens any more. US users send nearly 80 billion text messages per month.

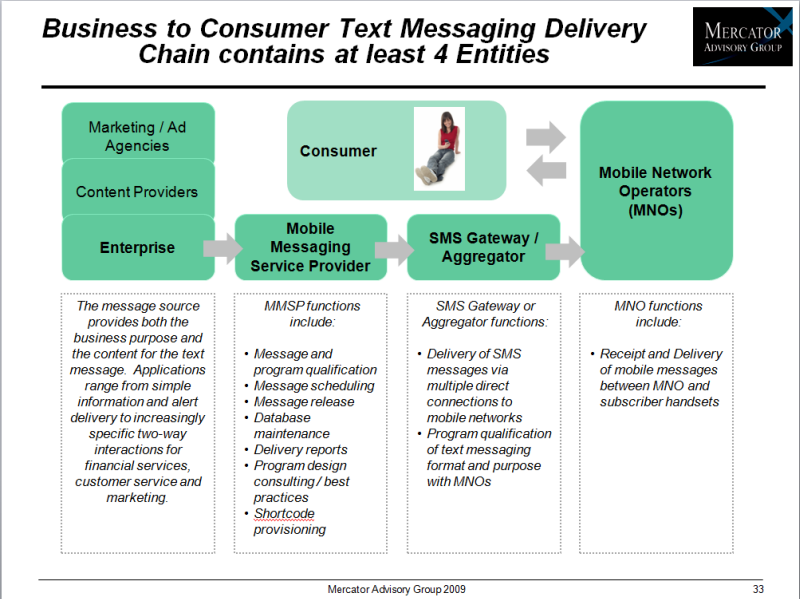

- Enterprise usage of text messaging requires careful planning and program management, including strong opt-in / opt-out provisions and message content oversight by the ultimate text messaging gatekeepers, the mobile network operators.

- Text messaging traffic in US financial services applications now exceeds 12 million messages per day and is growing over 100% per year.

- The application of text messaging to Collections has produced significant results when employed as an element in a multi-channel program.

An Exhibit included in this report:

This report contains 29 pages, 8 exhibit and 2 tables.

Companies and programs mentioned in this report include: Sprint, Verizon Wireless, AT&T, MetroPCS, SoundBite Communications, Walmart, DaysInn, Bank of America, Papa John's, Facebook, Prairie Interactive Messaging, ClairMail, Apple.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send E-mail to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world???s largest payment issuers, acquirers, processors, and associations to leading technology providers.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world