Overview

Boston, MA

October 2006

Third Annual Closed Prepaid Market Performance: Spend, Growth and Opportunity

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of our second of three reports comprising our 3rd Annual Prepaid Market Performance Survey.

These reports are the only market research available that:

1. Measures the total dollars loaded on prepaid instruments since 2003, providing a detailed record of market changes occurring in 34 different market segments.

2. Documents the changes occurring in 34 specific prepaid segments. Most research fails even to identify exactly what market segments it includes (making the numbers cited meaningless) and few even measure all of the most active segments that includes Open Gift Cards, Remittance, Money & Financial Services Cards, In-Store Gift Cards, Distributed Gift Cards (Prepaid Malls), Campus, Transit, Unemployment, Court Ordered Payments, Payroll, Consumer Incentives, Employee & Partner Incentives, FSA/HSA, Mobile Minutes, and Long Distance. This report documents changes and spending in these segments as well as 19 others.

3. Identifies the total market opportunity associated with all 34 market segments.

4. Measures dollars loaded through Open Networks in all 34 segments that had active Open Solutions deployed (cards issued by banks and identified by a major association brand) and through Closed Systems (cards that are issued and redeemed by a single organization). Ten of the segments in this report have spending conducted on both Open and Closed solutions.

Selected findings from the report include:

- The total spend on all 34 Prepaid Segments in 2005 was $165 billion, an increase of $18.46 billion over 2004.

- The average growth rate for all 34 Prepaid Segments in 2005 was 31%

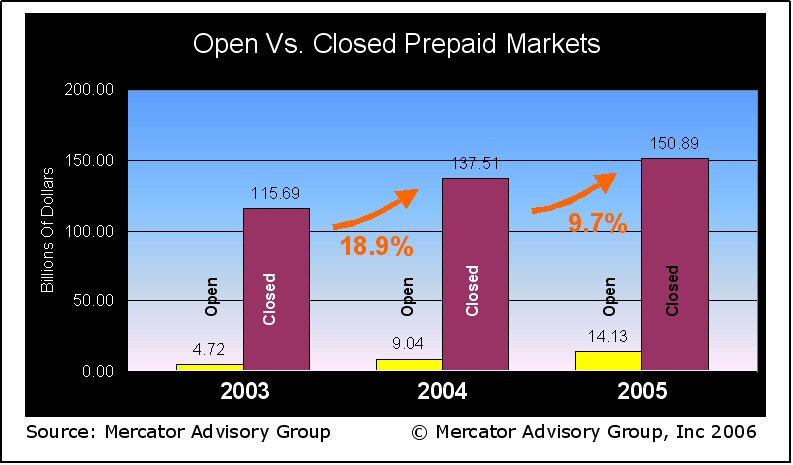

- Spending for all Closed Solution Segments totaled $150.9 billion, an increase of 9.7% from the $137.5 billion spent in 2004.

- The two fastest growing closed segments were the Games & Ring Tones and Distributed Gifts markets, which both grew by more than 50%

- Open solutions have broken into segments once assumed exclusive to closed solutions. This report identifies revenue collected over Open Networks that implemented Closed Loop In-Store Gift Cards, Distributed Gift and Campus transactions. While the volumes are small, they are growing rapidly.

- Open Solutions are making in-roads into closed markets because they greatly reduce the effort and cost associated with deploying solutions to new retail locations while network transaction fees directly couple costs to revenue generating events, eliminating, or greatly reducing the large capital equipment costs of POSA deployment.

- Several FIs and Branded Network Operators are making significant investments designed to help them penetrate key Closed Segments, establishing a strong first-mover advantage.

"The arrival of 'open solutions' on the closed network scene is a critical shift in the way we think about nationally branded solutions (Visa, MC, American Express, Discover) because in a prepaid context they are limiting acceptance for particular merchants and solutions to behave in a 'closed' configuration while, in some cases, still riding the association driven rails. The potential for expansion of this type of solution is enormous," comments Tim Sloane, Director of Mercator Advisory Group's Debit Advisory Service.

This report identifies that the total spend of Closed Solutions, across all Prepaid Segments that had Closed Solutions was $150.9 billion. This represents a significant increase of more than $13.4 billion over open spending in 2004.

One of the 25 Exhibits included in this report:

The report is 36 pages and contains 25 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world