Overview

Boston, MA

September 2006

Third Annual Open Prepaid Market Performance: Spend, Growth and Opportunity

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce that the first of three reports of our 3rd Annual Survey of the Prepaid Market is now available. These reports are the only market research available that:

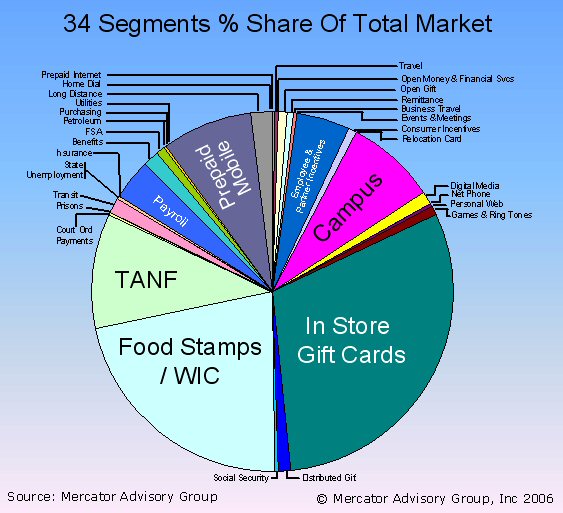

1. Measures the total dollars loaded on prepaid instruments since 2003, providing a detailed record of market changes occurring in 34 different market segments.

2. Documents the changes occurring in 34 specific prepaid segments. Most research fails even to identify exactly what market segments it includes (making the numbers cited meaningless) and few even measure all of the most active segments that includes Open Gift Cards, Remittance, Money & Financial Services Cards, In-Store Gift Cards, Distributed Gift Cards (Prepaid Malls), Campus, Transit, Unemployment, Court Ordered Payments, Payroll, Consumer Incentives, Employee & Partner Incentives, FSA/HSA, Mobile Minutes, and Long Distance. This report documents changes and spending in these segments as well as 19 others.

3. Identifies the total market opportunity associated with all 34 market segments.

4. Measures dollars loaded through Open Networks in all 34 segments that had active Open Solutions deployed (cards issued by banks and identified by a major association brand) and through Closed Systems (cards that are issued and redeemed by a single organization). Ten of the segments in this report have spending conducted on both Open and Closed solutions.

This report reveals that Open Networks, including American Express, Discover (Pulse), MasterCard, and Visa, all have established in-roads into a market segment once exclusively controlled by closed systems - In Store Gift Cards. While this penetration, as measured in both transactions and dollar volume, was small when compared to the almost $50 Billion spent on Closed Loop solutions for In-Store Gift Cards in 2005, there are two major implications. First, the ubiquity of Open Systems can deliver important advantages over Closed Systems in some situations - how broadly Open Systems will penetrate these markets have yet to be determined. Secondly, being able to transport non-financial data over the networks deployed by Open Networks represents a huge new market opportunity. If Open Networks can reliably deliver a wide range of non-financial messages and message types over the existing infrastructure, then a whole new range of business-to-business and business-to-consumer transactions become possible.

"On the surface, the potential for non-financial transactions over existing Open Networks appears enormous, but this assumes existing networks are transparent to content and nothing could be further from the truth," noted Tim Sloane, Director of Mercator Advisory Group's Debit Advisory Service. "While the potential is huge and there are several proof of concept implementations in place today, these are relatively narrow implementations. To expand the market to its full potential networks must achieve transparency for a wider range of message types, and this will require coordination of Merchants, Merchant Processors, Issuers, and the Issuer's Processors both technologically and contractually."

This report identifies that the total spend of Open Solutions, across all Prepaid Segments that had Open Solutions was $14.1 Billion. This represents a significant increase of more than $4.1 Billion over open spending in 2004.

Open Gift Cards are recognized as a separate market segment distinct from Open Money Cards in this report while Money Cards have been re-defined to include Open Prepaid Solutions that are increasingly being bought and sold through merchant retail locations along with Open Gift Cards.

The increasing adoption of the merchant retail locations as a place where consumers acquire their Open Prepaid Cards should be watched closely by financial institutions, since it creates an important new channel. Financial Institutions interested in high volume, or that want to target the unbanked and under-served may want to study this channel of distribution more closely.

Mercator Advisory Group predicts that merchants will get a significant uplift in product sales if bank-branded products are made available through the retail channel. While it was unclear who would regulate retail Open Prepaid Solutions in 2005, these issues are beginning to clarify in 2006. While regulatory and compliance uncertainty remain, the opportunity to drive unit volume and to access the un-banked and the under-served represents significant opportunity. Financial institutions that have a brand presence that can positively impact the buying decision of consumers in the merchant retail channel should evaluate this market at least every six months.

One of the 4 Exhibits included in this report:

The report is 37 pages and contains 25 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world