Overview

Third-Party Walk-In-Bill Payments in the United States

New research by Mercator Advisory Group profiles

nine bill payment processors

Boston, MA -- Walk-in bill payments provide an option for people who need to make payments but cannot or choose not to do so with an electronic means of payment or a check. Typically, these customers visit a retail location, kiosk, or biller's office to make a payment using cash. While other forms of payments are sometimes accepted, the most common form of payment is cash.

Mercator Advisory Group's new report, Third-Party Walk-In Bill Payments in the United States, focuses on payments made where the payer physically visits an agent location, such as a check casher, customer service desk in a grocery store, or kiosk to make a payment primarily by cash or check. It describes the market opportunity and the business model for walk-in bill payments and provides brief profiles of several major and emerging service providers.

The report covers third-party providers of these services. It does not include walk-in bill payments made directly at a biller's offices, money orders, online bill payments, or automatic bill payments. While this report notes where the major providers have significant overseas presence, it concentrates on the walk-in bill payment market in the United States.

"The future of walk-in bill payments is caught up in the tension between a number of conflicting trends," says Ben Jackson, senior analyst and author of the report. "Some of them seem to indicate that the business is likely to grow, while others would seem to indicate that walk-in bill payments will fade over time."

The report discusses these trends and covers possibilities and opportunities for financial institutions and other financial services companies.

Highlights of the research findings include:

The benefits of walk-in bill payments for billers and some states

The entities that offer walk-in bill payments

New delivery channels for third-party walk-in bill payments

A review of the business model for third-party bill payments

The regulations third-party processors are subject to, at both the federal and state level

The types of businesses dominating the market

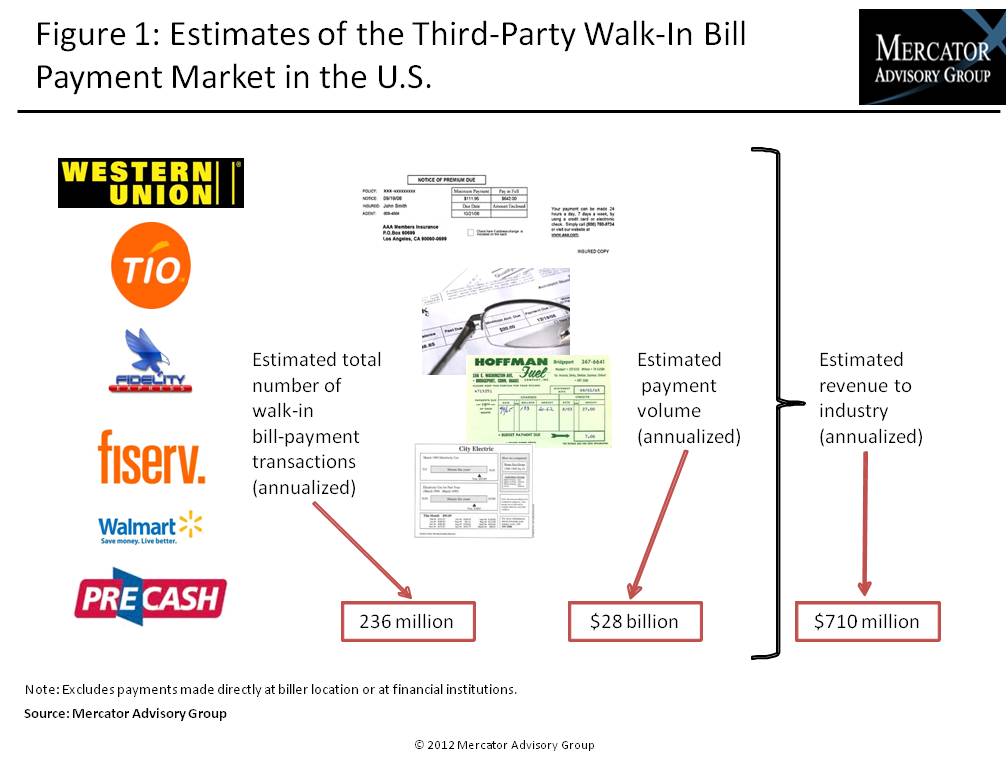

One of the seven exhibits included in this report:

This report contains 25 pages and seven exhibits.

Companies mentioned in this report include: Western Union, MoneyGram, TIO Networks, Fiserv, Softgate Systems, Fidelity Express, epay, PreCash, Global Express, Fuze Network, PayNearMe, and ZipZap Inc.

Members of Mercator Advisory Group's Debit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world