Overview

Top 50 Debit Card Issuers Loyalty and Rewards Programs 2009 - Year in Review

Boston, MA - December 7, 2009 -- Consumers have spoken and their electronic payment of choice is debit. Yet that popularity comes with a price in the form of a more competitive, mature market for traditional debit card issuers. A point of differentiation can be achieved through loyalty and rewards programs and since 2004, Mercator Advisory Group has examined annually programs from the top 50 U.S. debit card issuers.

In an attempt to unwind the debit card rewards market, this year Mercator Advisory Group expanded our analysis to include more program characteristics, offering a better insight into the strategies designed to motivate consumers to accept a debit card and use it. These characteristics also offers a glimpse into the changing economics of these programs, one of the greatest challenges facing debit card program managers. We spotlight programs that show promise, take a look at issuers who continue to sit on the fence, and examine the offers in which simplicity delivers a knockout result.

Mercator Advisory Group's the Top 50 Debit Card Issuers, Loyalty and Rewards Programs, 2009 Year in Review not only serves to examine the current market, but also discusses the changing nature of these programs over time as well as what some of the emerging trends indicate for the future. We also discuss the results of issuers who have bucked the trend by not offering reward programs and how they differentiate themselves in an increasingly hyper-competitive market.

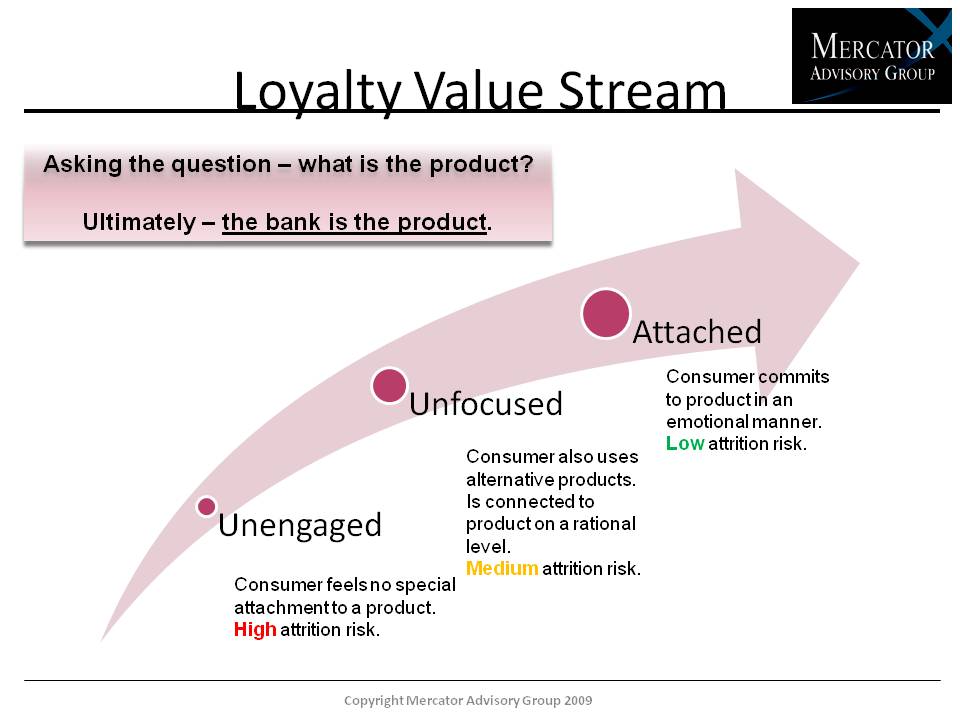

"While many good and effective RLP schemes borrow their benefits from the credit card market, we would argue that the underlying value of these programs for the traditional debit card market should be to firmly establish the value of the consumer to their depository bank and the depository bank as the consumer's trusted financial services partner." Patricia Hewitt, Director of Mercator Advisory Group's Debit Advisory Service comments. "This is accomplished by designing relevant, authentic programs that consumers can access and interact with across multiple delivery channels."

Highlights of this report include:

A detailed matrix of the top 50 debit card issuers' rewards and loyalty programs including characteristics and qualifications for participation.

Debit reward program characteristics are expanding to incorporate use of other banking services; reflecting a shift in focus from revenue alone to revenue and cost management.

Merchant Funded Discount Networks are being used by more debit card issuers.

Consumer surveys indicate rewards programs are not top of mind, but results tell a different story.

More program types are operating in the market than ever before, offering the opportunity for issuers to craft programs that more closely align to the overall bank's brand positioning.

One of 10 exhibits in this report:

This report is 30 pages long and has 10 exhibits.

Companies mentioned in this report include: Visa, MasterCard, Bank of America, Citibank, Wells Fargo, JPMorgan Chase, SunTrust, Fifth Third, M&T Bank, Comerica, Zions Bank, Harris Bank.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world