Overview

A new research report from Mercator Advisory Group, Transit and Tolls: New Tracks for Growth in Prepaid in the U.S., examines how prepaid payments are displacing cash in both mass transit and highway tolling. The two sectors offer market opportunities for prepaid providers across the value chain, but challenges remain.

The Transit and Tolls segment of the prepaid market encompasses a variety of form factors, including closed-loop magnetic-stripe cards, open- and closed-loop contactless cards, transponders, and increasingly mobile apps. All hold promise for reducing the role of cash and cash handling in major transportation systems.

“Despite the challenges of legacy systems and government contracts, transit and tolling offer opportunities for companies all along the prepaid value chain from issuers to processors to distributors,” said Ben Jackson, Director of Mercator Advisory Group’s Prepaid Advisory Service and coauthor of the report. “As transportation payment systems adopt new technologies, prepaid will be an important source of funds for commuters of all types.”

This report is 20 pages long and contains 7 exhibits.

Organizations mentioned in this report include: Chicago Transit Authority, Cubic Transportation Systems Inc., E-Z Pass, FasTrak, GeoToll, Masabi, Massachusetts Bay Transit Authority, Minnesota MNPASS, Ring Theory, SunPass, TxTag, TollTag, Utah Express Lane

Members of Mercator Advisory Group's Prepaid Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

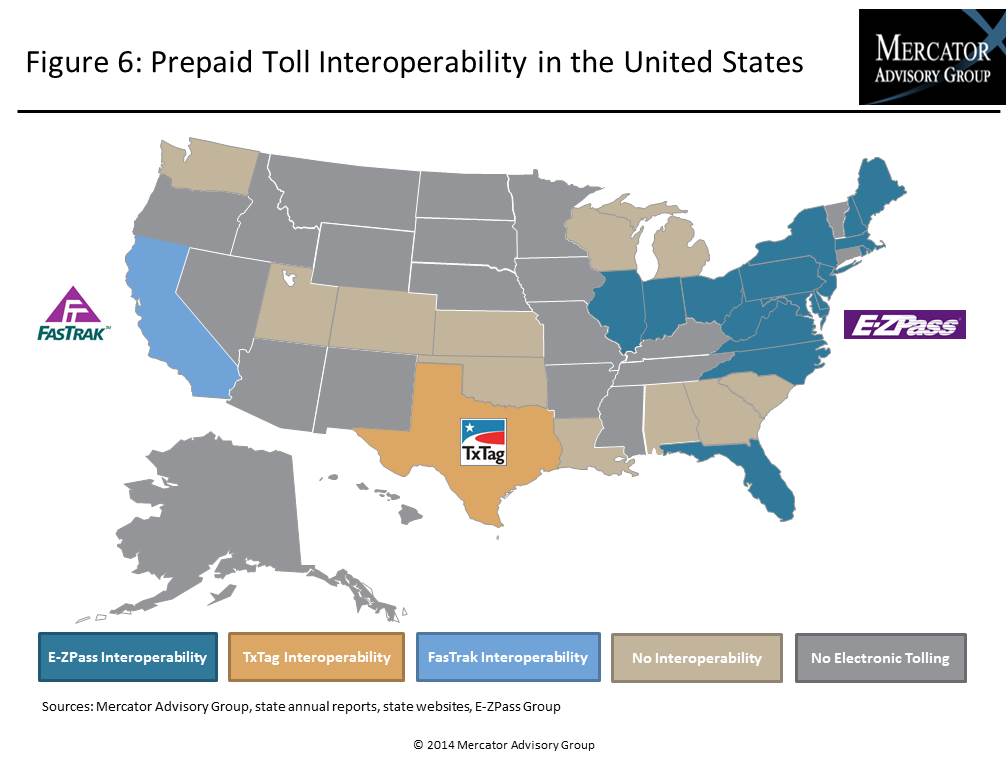

One of the exhibits included in this report:

Highlights of the report include:

- Mercator Research Group’s estimates of market size in the United States for both mass transit and highway tolls

- Estimates of prepaid transit fare revenue in terms of amount loaded on closed-loop cards on buses, light rail, and commuter systems

- The prospects for mobile ticketing and fare payment in light of concerns about accessibility to this payment mode for less affluent and underbanked system users

- Mercator Advisory Group’s data showing increasing revenues from toll road facilities for every year since 2010 despite stagnant growth in the overall vehicle miles traveled in the United States (according to the Federal Highway Administration)

- Prospects for widespread adoption of electronic toll collection and prepaid tolls, whose growth outstrips that of toll revenue, leading to a higher percentage of tolls from prepaid accounts than in previous years

- Ways for states to achieve interoperability of highway toll systems, which could boost prepaid toll collection significantly, and the example of a company that is seizing a market opportunity by aggregating protocol information for transponders through a single mobile application on smartphones

- Market opportunities for prepaid providers

Learn More About This Report & Javelin

Related content

Payments in the Arena: Prepaid Can Move Into the Starting Lineup as Cash Gets Cut

Sports and entertainment thrive on fan loyalty but have yet to translate that dedication into long-term, connected share of wallet once fans are inside the turnstiles. Prepaid stor...

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

Make informed decisions in a digital financial world