U.S. Commercial Card Market: Efficiencies And Innovation Drive Growing Adoption

- Date:December 20, 2009

- Author(s):

- Mercator Research

- Research Topic(s):

- Commercial & Enterprise

- Credit

- PAID CONTENT

Overview

U.S. Commercial Card Market:

Efficiencies And Innovation Drive Growing Adoption

Boston, MA -- Dec. 21, 2009 - Today, commercial cards are being used worldwide for a broader range of purposes, in a broader range of purchase environments. Corporations are seeking increased operating efficiency by every means possible, as well as better data to support more effective management decision-making. The leading card networks and the issuing banks are all responding with expanded offerings to reduce costs, minimize risk (both for the issuer and for the corporate customer), and maximize informational utility, and many of their offerings are available internationally.

Both large and mid-sized corporations are operating today in an unusually stressful and unforgiving economic environment. They must reduce administrative processing costs, but must not cut corners on risk controls. They must enable employees to do their jobs as efficiently as possible, but must conserve their cash and credit resources. They know that detailed spending analyses will enable them to save money by optimizing sourcing and consolidating buying power, but are unsure that the potential savings to be gained will justify the cost of carrying out such analyses. These challenges are real, and the commercial card industry has responded with a steady flow of technical enhancements aimed at overcoming these potential barriers.

"As of 2009, the game has changed in commercial cards for mid-to-large corporate clients. Just a few years ago, the travel sector was driven by executive convenience, and the purchasing sector was focused on reducing processing costs for small-ticket purchases such as office supplies and light bulbs. The pressures of the current economic downturn have forced corporations to look for savings wherever they can find them, and the commercial card business has opened into entirely new transaction segments," Ken Paterson, VP for Research Operations at Mercator Advisory Group comments.

Highlights of the report include the following:

U.S. corporations, pressured by the recession to reduce costs, are increasingly willing to consider card-based solutions for a wider variety of purchase and payment needs.

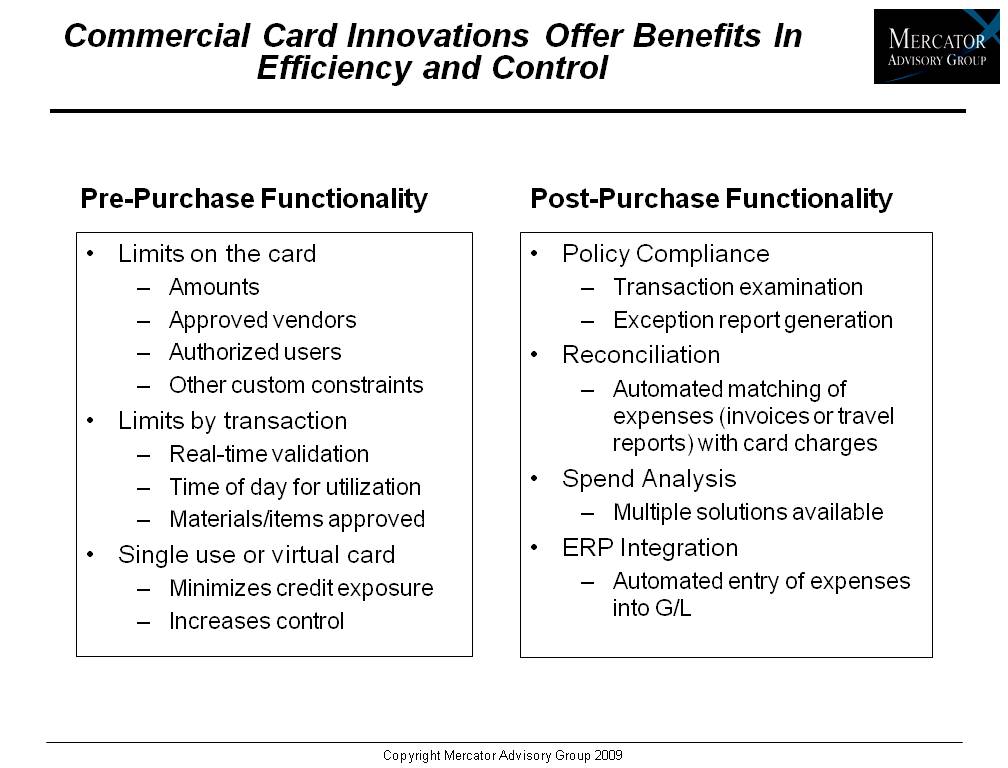

The three leading card networks have substantially strengthened their card management offerings in the past year, improving both pre-purchase controls and post-purchase analytics.

Commercial cards involve credit risk to the issuer, and corporations should ensure that card programs, especially for purchasing, are part of a broader relationship with an issuer that understands their business.

Commercial card issuance for the mid-to-large sized firm is highly concentrated, and tools offered by issuers may vary substantially.

Pricing is in flux, impacted significantly by enhanced data granularity, growing transaction sizes, and bundling of supporting software and services.

One of the 10 Exhibits included in this report

The report is 46 pages long and contains 15 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information about the Mercator Consumer Payments Survey Research Series, call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world