Overview

In the spring of 2011, Visa issued a road map for the U.S. adoption of a smartcard-based payments ecosystem. Since then, the other three major U.S. payments networks have followed suit. These road maps provide milestones for merchants, acquirers, and processors, along with dates on which these milestones are expected to be met. In theory, the road maps should serve as a reasonable expectation for when the U.S. will fully adopt EMV, but judging by past experience, that likely won't be the case.

"The roadmaps laid out by the networks intend to convert the U.S. payments ecosystem to EMV by 2015, four years after the first road map was developed," says Dave Kaminsky, senior analyst in Mercator Advisory Group's Emerging Technologies Advisory Service and author of the report. "Judging by the experience of other countries in trying to implement EMV, as well as the experience of the networks' previous attempts to influence changes among U.S. merchants, that timeframe likely will not be met."

One of the exhibits included in this report:

- Analysis of why the U.S. did not convert to EMV when many European countries did and why the U.S. is currently motivated to adopt EMV

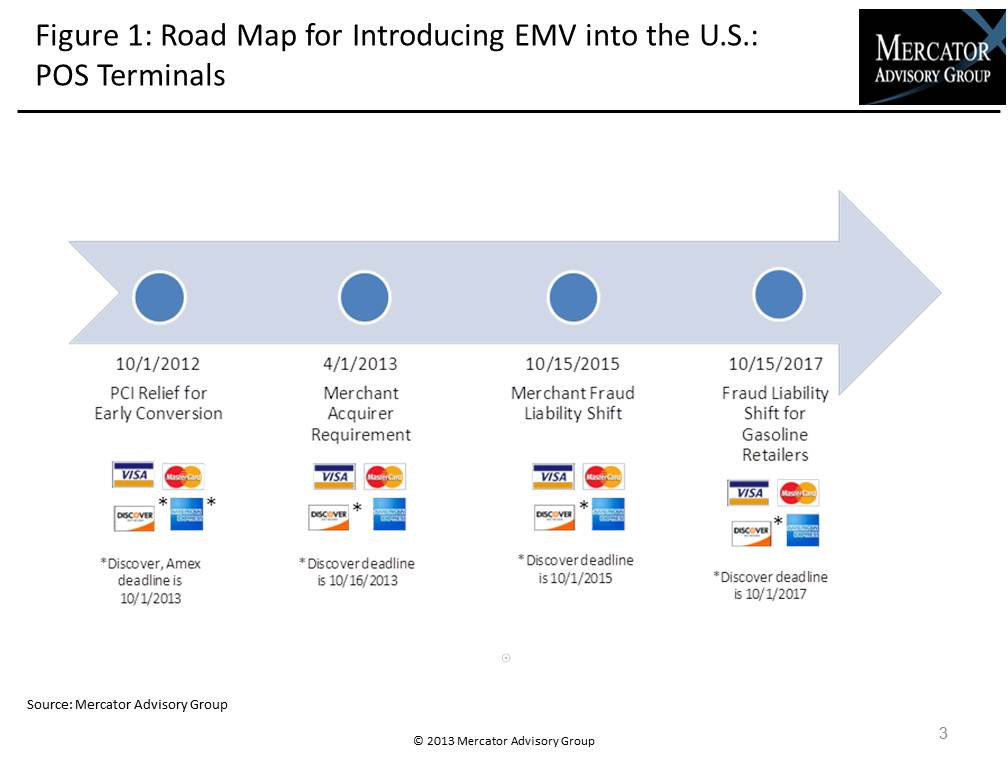

- Detailed breakdown of the current road map, including explanations of all major milestones, deadlines each network has set for each milestone, and penalties for noncompliance

- Forecast of U.S. EMV conversion based on the networks' timeline and the actual adherence of merchants, financial institutions, payments service providers, and consumers to previous timelines in the U.S. and abroad

This report is 24 pages long with nine exhibits.

Companies mentioned in the report include: Visa, MasterCard, Discover, American Express, Europay, EMVco, and JCB.

Members of Mercator Advisory Group's Emerging Technology Advisory Service have access to this report as well as the upcoming research for the year ahead,

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world