Overview

May 2008

US Mobile Banking: Sedate Growth, Disruptive Potential

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, "US Mobile Banking: Sedate Growth, Disruptive Potential.

Mobile banking will be a disruptive force for smart FIs willing to tailor their message to specific demographics. Otherwise, mobile banking is in danger of becoming "yet another" convenience feature leaving the broad flank of the FI community exposed to more nimble players wielding mobile-enabled alternatives. A mobile-enabled decoupled platform is just one possibility.

For C-level and operational leadership at large retail banks, credit unions and community banks, this new report examines the US deployment of mobile banking and finds a steady yet uneven growth path with financial institutions taking a range of deployment options and marketing approaches.

Among the report's findings is the lack of demographic and solutions focus among even some of the most aggressive proponents of mobile banking. This diffuse consumer education and marketing leaves enormous opportunity to FIs and other competitors willing to put some "wood behind the arrow" of their mobile marketing initiatives.

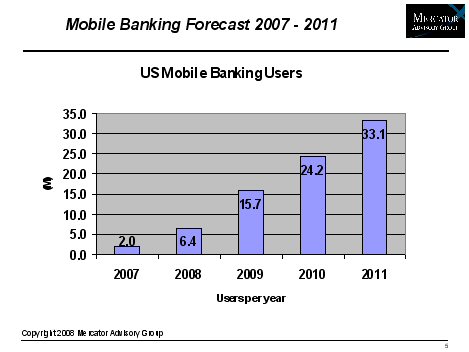

Despite the current state of marketing, the report includes a strong growth forecast through 2011.

The report concludes with a discussion of mobile banking as training wheels for consumers of mobile financial services and mobile payments.

Highlights from this report include:

- Across the FI landscape, mobile banking deployment is proceeding unevenly. Just 17% of the largest banks have deployed and 0% of the largest community banks. On the other hand, 23% of the largest credit unions now have m-banking solutions in place.

- Steady growth in mobile banking users is forecast, from 2 million in 2007 to 33.1 million by 2012.

- FI marketing and consumer education will be determinants of mobile banking success. Uneven efforts to date speak to uncertainty around the business case and competing internal priorities.

- Mobile banking technology providers have lowered the bar through pricing at the low end and straightforward technical integration.

"M-banking has the potential, unlike many other channels, to be disruptive, capable of driving market share not only in youth markets, but also among small business owners, senior corporate banking customers in treasury-related roles and even the under-banked," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "That potential is unrealized and is waiting for smart FIs to capitalize on it."

Companies mentioned in the report include ACI Worldwide, Bank of America, Citi, Chase, CheckFree, First Data, Google, ING, PSCU, S1, Wells Fargo, BB&T, PayPal, mFoundry, ClairMail, Firethorn, Fronde, Fundamo, Macallan, Postilion, Monitise Americas, MShift, SRM Technologies, Yodlee, BART, Jack in the Box, Spring, SK Telecom, Verizon, and AT&T.

One of the 6 Figures included in this report

The report is 24 pages long and contains 6 exhibits and 1 table.

Other recent research from Emerging Technologies:

| |||||||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world