U.S. Secured Credit Cards Market Forecast, 2017–2021: A Credible Product with a Dark Past

- Date:September 28, 2018

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

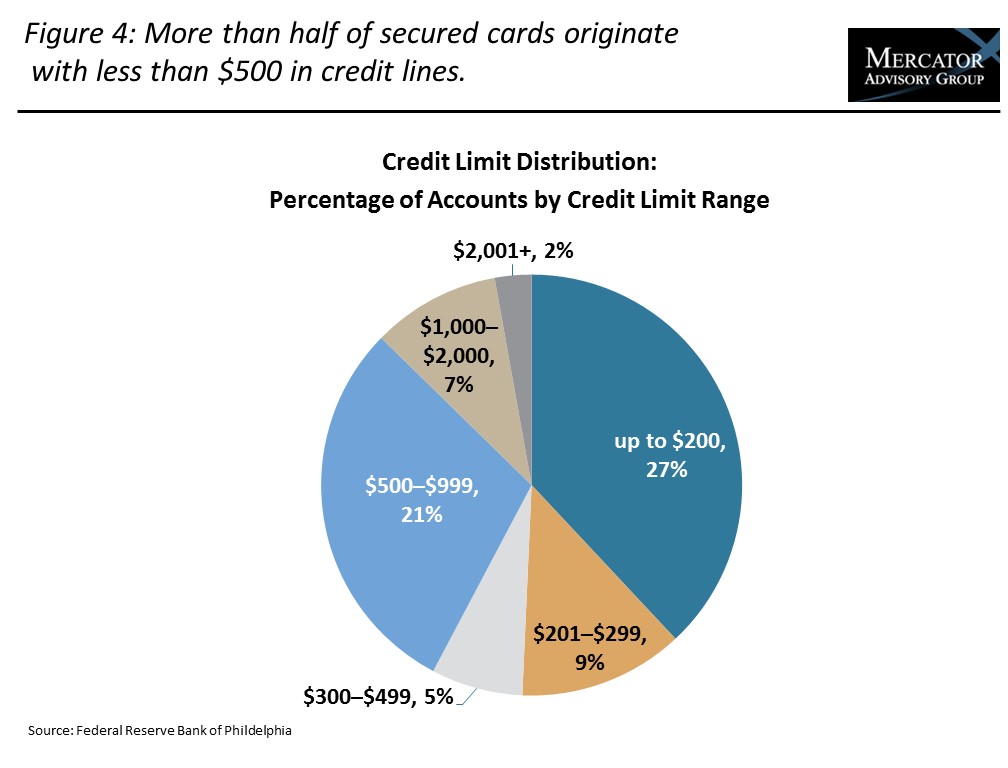

Secured credit cards, a product tainted by opportunistic marketers before the turn of the 21st century benefited from transparency and disclosure requirements mandated by the Credit Card Accountability Responsibility and Disclosures Act of 2009 (CARD Act). Today, top credit card issuing banks, specialty nonprime issuers, and credit unions serve the market with fair interest rates and payment terms. Prospective cardholders can qualify for the product at institutions including Bank of America, Citi, Discover, Green Dot, US Bank, and USAA for deposit balances well under $500.

Mercator Advisory Group’s latest research reporte, U.S. Secured Credit Cards Market Forecast, 2017–2021: A Credible Product with a Dark Past, provides a view of this market of 5 million cardholders and gives a detailed view of the issuing landscape.

“Secured cards used to represent the dark side of the credit card business, with gouging fees and deceptive 900-carrier billing numbers,” comments Brian Riley, Director, Credit Advisory at Mercator Advisory Group, and the author of the research report. “Since the CARD Act cleaned up deceptive practices and unconscionable lenders, secured cards offer a mutually beneficial proposition for issuers and credit-impaired consumers. Issuers can increase their interest and non-interest revenue and also nurture pathways to other products. Consumers who either are recovering from a household financial crisis or do not have established credit have the opportunity to be included in mainstream financial services.”

This document contains 18 pages and 9 exhibits.

Companies mentioned in this research report include: American Express, Bank of America, Barclays, Capital Bank, Capital One, Chase, Chevron Credit Union, Citi, Digital Credit Union, Discover, FICO, First Progress, Fiserv, General Electric Credit Union, Green Dot, Mastercard, Merrick Bank, Navy Federal Credit Union, NIH Credit Union, Open Sky, Synovus, US Bank, USAA, and Visa.

One of the exhibits included in this report:

Highlights of the research report include:

- How the secure card product evolved

- Demographics of the secured card product market in the U.S.

- Selected secured card issuers

- Segment risks and opportunities

- Operating technologies

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world