Overview

Boston, MA

December 2004

The US Small Business Credit Card Market

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

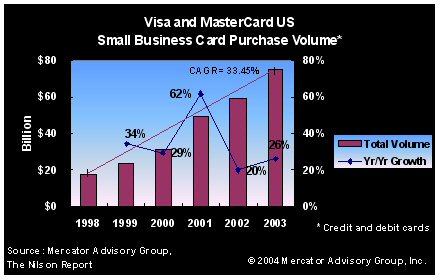

As the growth in general purpose card volume started to slow down in the 1990s, credit card issuers turned their attention to new categories, including debit and commercial cards in an effort to sustain growth. In the commercial card market there was rapid growth in the purchasing and corporate card segments in the early to mid 90s. While in recent years, small business cards have taken the lead.

Overall, the year-over-year segment growth rate was more than 20% every year over the 1998-2003 period. In 2001, Visa and MasterCard small business card purchase volume alone grew at a rate of 62%. Meanwhile, small business credit card outstanding receivables were up by 34.5 percent from $7.9 billion in 2000 to $10.7 billion in 2001. The segment continues to grow at double-digit rates driven by the growth in small business debit purchase volume.

Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service comments, "The small business credit card segment has been a major driver of growth for the U.S. commercial card category as well as the total credit card volume category. The future volume growth can be generated through converting small business check payments into plastic. Automated bill payment, professional services, health care, and telecommunications are some of the categories where the conversion can create significant charge volumes."

This report examines the U.S. small business credit card market looking at the characteristics of small business including the financial trends in the segment. It provides historical and current information on the U.S. small business credit market, and lays out the competitive landscape focusing on the top four U.S. small business credit card issuers.

The report contains 26 pages and 21 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world