Overview

Boston, MA

January 2009

Virtual Point-of-Sale: Diving in and Disappearing into the Line of Business Application

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, Virtual Point-of-Sale: Diving in and Disappearing into the Line of Business Application.

Since its inception, browser-based vPOS has helped countless merchants with MOTO and low-volume walk-up sales. It remains a useful approach for small merchants with only occasional need to handle card-based payments. It even has the option of supporting card present sales.

Beyond looking after these simple transactions, vPOS capability is diving into the line of business application that drives the merchant's sales process. From small businesses running Quickbooks to large enterprise users of Salesforce.com or SAP, payment capability is now an embedded feature of core business applications.

Payment enablement of a line of business application, arguably the best place for payments to take place, requires considerable effort. This new report examines two approaches to the problem of card payment enablement. The report concludes with an examination of how business applications on the iPhone are becoming payment enabled.

Highlights from this report include:

- Browser-based virtual point of sale (vPOS) continues to offer value to MOTO and low-volume walk-up merchants.

- vPOS capability, software-based payment transactions, is optimal when subsumed into a merchant's line of business application (LOB).

- The dedicated application add-in model, embedding payment processing capability into a line of business application, is a viable vPOS tactic for merchant acquirers and processors.

- IP Commerce flips the application add-in model by using a general purpose payments interface that speeds payment-enablement for the LOB software developer and gives wider choice as to processing partner to the merchant or LOB application user.

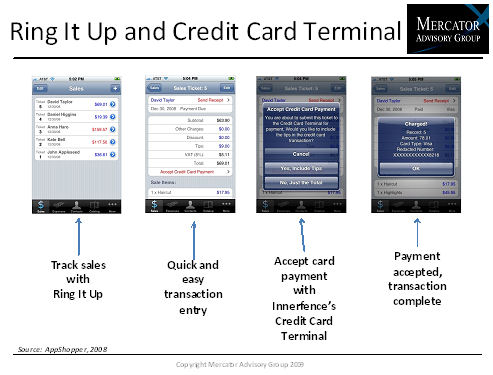

- Mobile vPOS is following an evolutionary path similar to PC-based approaches. Integrated LOP applications for very small merchants, including payments, are available now on the iPhone.

"While virtual point of sale terminals continue to do yeoman's work for small merchants with low walk-up volumes, the action is in enabling business application software to make and take payments," comment Elisa Athonvarangkul Tavilla, Senior Analyst of Mercator Advisory Group's Emerging Technologies Advisory Service. "As a volume driving strategy for merchant acquirers and processors, connecting up the line of business application's sales functions with payments capability makes sense. For merchants, it saves time and simplifies operations."

One of the 6 Figures and 2 Tables included in this report:

This report contains 26 pages, 6 figures, and 2 tables.

Other recent reports from the Mercator Emerging Technology Advisory Service:

| Text Messaging and Mobilizing Prepaid Financial Services: You Can't Beat Ubiquity | |||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world