Overview

Just 20 days before it will begin trading under its own ticker again on the Nasdaq, PayPal announced its intention to buy Xoom for $890 million. Xoom is a digital-focused remittance player that has enjoyed blistering growth with its total transaction volume recording a compounded annual growth rate (CAGR) of 68% in the last five years. Nevertheless, its new customer acquisition costs are high and it has struggled to retain a profit in the face of increased price competition from incumbents in the space like Western Union, MoneyGram, and Ria Money Transfer.

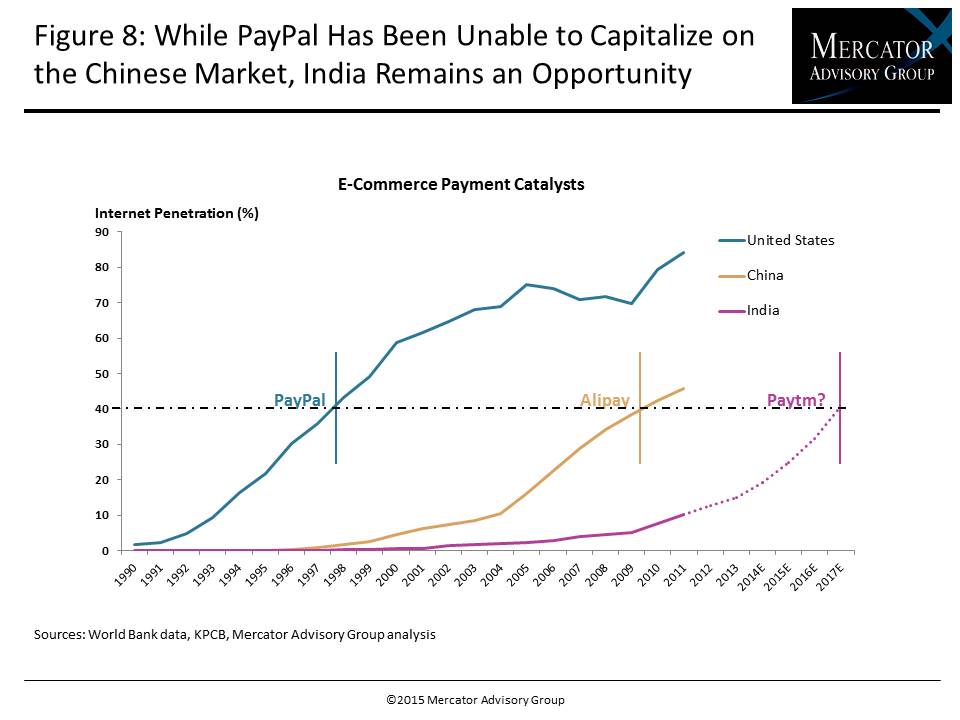

Despite the fact that over half of PayPal’s transaction volume comes from outside the United States, it has struggled to establish itself in fast-growing e-commerce markets like China and India. Mercator’s research note, Why PayPal Bought Xoom: Emerging Markets Opportunity Too Good to Ignore, strategically analyzes the competitive advantages of both these companies and argues there is a strong case for synergies to be realized that can prove mutually beneficial.

“In emerging markets especially, prepaid digital wallets are a hugely popular means of funding e-commerce purchases, a trend that PayPal has been unable to capitalize on as local players such as Alipay in China and Paytm in India have established their dominance. Remittances could be the Trojan horse that enables PayPal to crack these markets, representing a cost-effective way of acquiring new PayPal users,” comments Nikhil Joseph, Emerging Technologies Analyst at the Mercator Advisory Group and author of the note.

The research note contains 12 pages and 8 figures.

Companies mentioned in this research note include: Alibaba, Alipay, eBay, Money Gram, PayPal, Paytm, Ria Money Transfer, and Xoom.

Members of Mercator Advisory Group’s Emerging Technologies Advisory Service have access to this note as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of the research note include:

- Overview of the key trends in the global remittance business

- Analysis of Xoom’s growth over the last five years and what its weaknesses have been

- Review of where PayPal stands today at separation from eBay and what its strategic priorities need to be

- Identification of the opportunity that exists in emerging markets and why Xoom could prove useful in helping PayPal capitalize on them

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world