B2B E-Commerce: The Challenges and Opportunities Caused by Digital Acceleration

- Date:March 26, 2021

- Research Topic(s):

- Commercial & Enterprise

- Global

- Merchant

- PAID CONTENT

Overview

Pandemic-related disruptions caused digital business-to-business (B2B) sales to surge for all online channels.

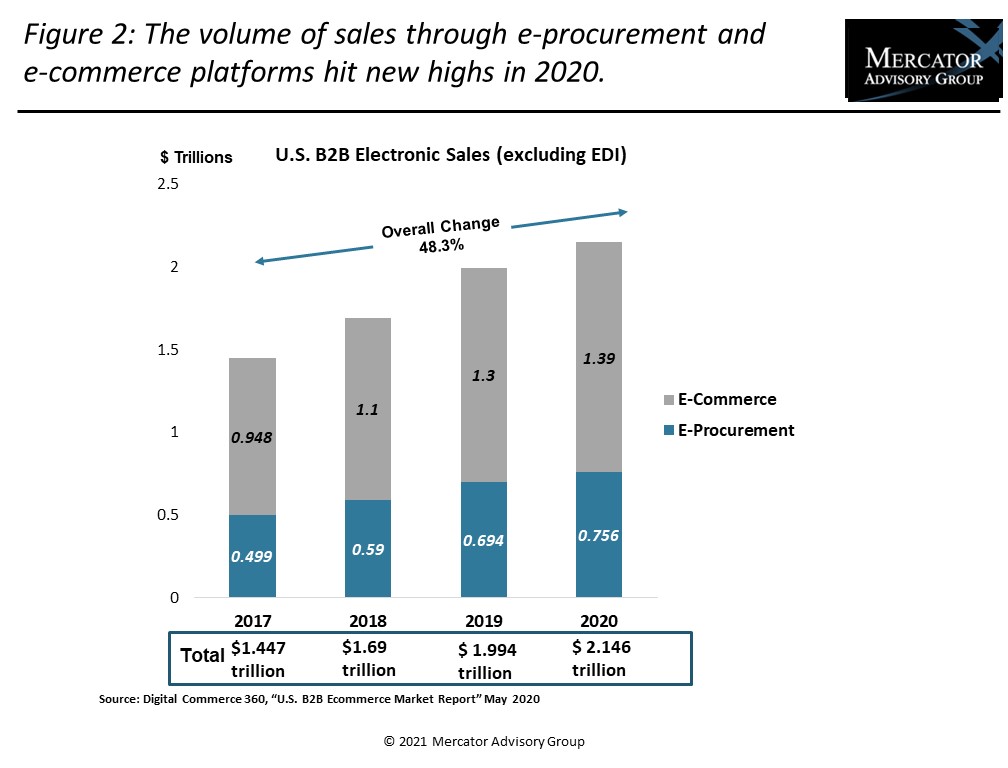

In a new research report, B2B E-Commerce: The Challenges and Opportunities Caused by Digital Acceleration, Mercator Advisory Group examines the pandemic’s impact on B2B sales. Specifically, Mercator examines how the digital transformation in B2B commerce, which began prior to the pandemic, has been greatly accelerated. Depending on the definition of B2B e-commerce, there are multiple estimates as to its size, both globally and in the United States. Nonetheless, with COVID-19 disrupting physical sales, B2B e-commerce volumes have surged for all electronic sales channels. Now, B2B e-commerce volumes exceed consumer (B2C) e-commerce volumes, while both e-commerce types are experiencing remarkable growth. Even as the pandemic subsides, the growing importance of e-commerce in the B2B industry will persist; digitalization is here to stay.

In the report, Mercator focuses on the rise of B2B marketplaces, which are especially important as workplace demographics shift and customer expectations for seamless digital experiences continue to shape the landscape. We identify the functionality and features that will define successful B2B marketplaces as digitalization continues. Mercator then discusses where the financial services industry can find some success in the growing B2B marketplace space via specific opportunities.

“Total sales on B2B e-commerce sites grew 10% to $1.39 trillion in 2020, and when e-procurement sales are included, digital B2B sales totaled over $2.19 trillion. And that’s excluding sales on EDI platforms,” commented Daniel Banta, Analyst, Mercator Advisory Group and co-author of the report. “Though B2B marketplaces currently make up a modest share of all electronic sales, it appears the B2B industry is heading to an eventual marketplace-dominated distribution model.”

This research report is 17 pages long and contains 4 exhibits.

Companies mentioned in this report include: Amazon, Alibaba, Capital One, Chase, Epicenter, IBM, JP Morgan, Kabbage, Kinnek, Lending Tree, Magento, Marqeta, Oracle, Predix, PunchOut2Go, Salesforce, Shopify, Spryker, Square Capital, Thomas.net, Virto Commerce, and Wells Fargo.

One of the exhibits included in this report:

Highlights of the report include:

- Detailed review and clarification of e-commerce methods and approaches for the B2B space

- Examination of COVID-19’s impact on physical and digital B2B sales trends

- A review of the demographic factors driving marketplace preferences

- A summary of the most important features and functionality that B2B marketplaces should offer to meet digital-centric expectations

- Detailed analysis of financial services industry opportunities in payments and lending as they relate to B2B marketplace disruptors

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world