Digital Corporate Payables: A Complicated and Changing Landscape

- Date:June 28, 2016

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

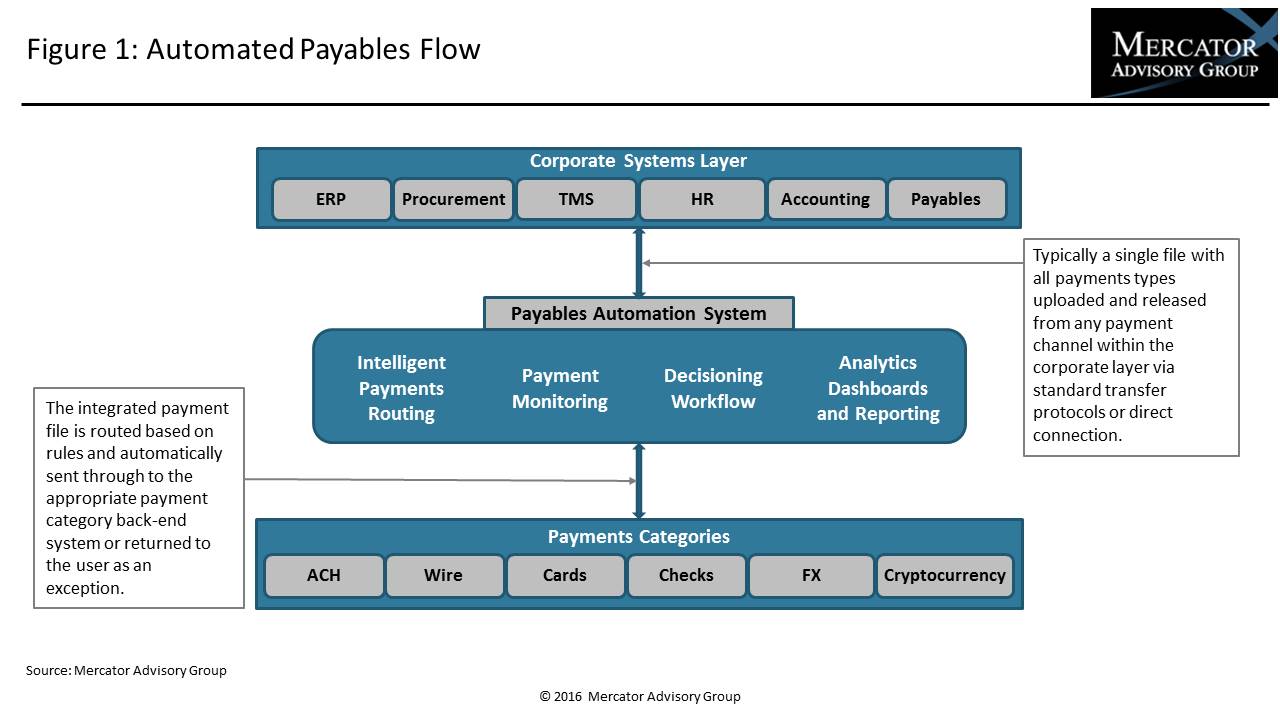

In a research note, Digital Corporate Payables: A Complicated and Changing Landscape, Mercator Advisory Group defines traditional automated payables systems and then compares and contrasts them with some of the myriad other systems that occupy the vast and complex world of corporate payments. The note also provides a high-level sampling of information about vendors offering solutions across the ecosystem, as well as ways in which banks can help their corporate clients make the correct choices for their unique structures.

"It is part of a financial institution’s remit to provide proper advice to its corporate clients. Corporations look to banks for a better understanding of the payments landscape so they can take advantage of opportunities to improve cash management efficiency,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Through a deeper understanding of their clients’ particular needs, gained through operational and transactional intelligence, banks can foster greater loyalty.”

The note is 10 pages long and contains 4 exhibits.

Companies mentioned in this research note include ACI, AOC, Ariba, D+H, Fiserv, iPay, Transcepta and TSYS.

One of the exhibits included in this report:

- Definitions of various digital payments systems and how they often integrate

- Graphical depictions of several digital payments models and systems

- Distinguishing between infrastructure and software in corporate and bank digital payments

- A discussion and chart of various ways digital payments integrate with the procure-to-pay corporate process flow.

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world