Dodd-Frank and Corporate Banking: Still Murky After All These Years

- Date:January 24, 2018

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In a new research report, Dodd-Frank and Corporate Banking: Still Murky After All These Years, Mercator Advisory Group examines the legislation to understand how it has affected corporate banking entities, and as such, what might change should various possible adjustments be made during the current administration.

"It is difficult to quantify the benefits of the Dodd-Frank Act since it was intended to improve safety of the banking industry and fairness toward consumers in the abstract. The sweeping piece of legislation as structured left many unanswered questions about its potential impact, so we decided to take a look now and see what might be evident, commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “As one might expect, for bank holding companies, compliance costs have become a larger part of business unit operating expenses. There is also evidence of unbalanced commercial lending constraints and pressured revenue margins, which banks have to manage. But a more insidious, longer-term impact may come from the underlying structure of the legislation, which leaves rules changes as a contentious political playground.”

This report is 19 pages long and has 6 exhibits.

Companies mentioned in this report include: ACL, Appian, CetoLogic, Convergepoint, Datamatics, Earnix, Finastra, FIS, Jack Henry, Moody’s Analytics, Nomis, Novantas, Openlink, Oracle, RSA Archer, SunTec, THC Network, Thomson Reuters, Wolters Kluwer, and Zafin.

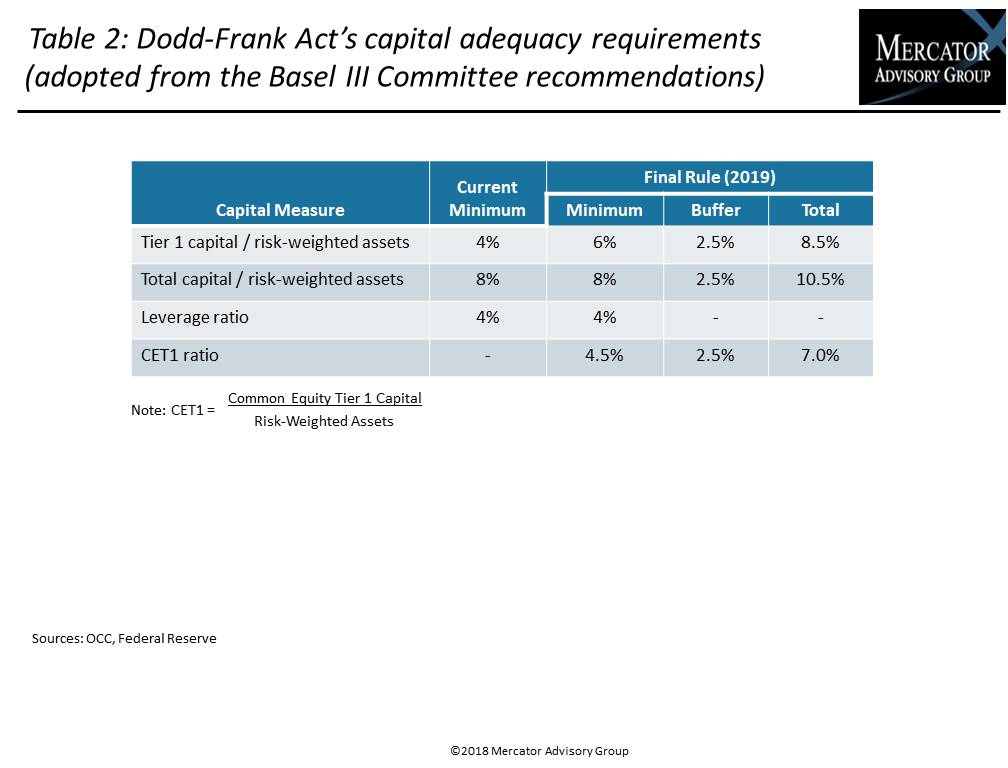

One of the exhibits included in this report:

- A detailed review of Dodd-Frank sections that are most directly related to corporate banking businesses

- Analysis of the incremental compliance costs, as well as possible benefits

- A detailed comparison of two scenarios showing the impact of the liquidity coverage ratio on balance sheet flexibility

- Discussion of the proposed changes to the law and most likely outcomes

- Decisions that banks can make to best manage their portfolios going forward

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world