The Enemy at the Gates: Payments Fraud Is a Symptom

- Date:February 14, 2017

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In a new research report, The Enemy at the Gates: Payments Fraud Is a Symptom, Mercator Advisory Group discusses the increased cyber threat faced by financial institutions and their clients and how that helps to create opportunities for payments fraud schemes. Payments fraud is a symptom of the broader issue of cybercrime, but it can also be somewhat independently controlled or minimized. In this report Mercator reviews the underlying issues around the global fraud threat and their relation to payments fraud and identifies actions that financial institutions and their clients can take to help manage the threat going forward.

"The cost of dealing with fraud incidents goes beyond the actual financial loss, with aftershocks ranging from client dissatisfaction to damaging reputational hits, something of particular concern to financial institutions given follow-on regulatory actions,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Managing the threat requires a series of actions including process controls and systems deployment to identify, prevent, and limit the damage.”

The report is 18 pages long and contains 6 exhibits.

Companies mentioned in this research note include ACI, BAE Systems, Cisco, CSC, CyberSource, Experian, FICO, FIS, Fiserv, Guardian Analytics, HPE, IBM, Intel, Microsoft, and Verizon.

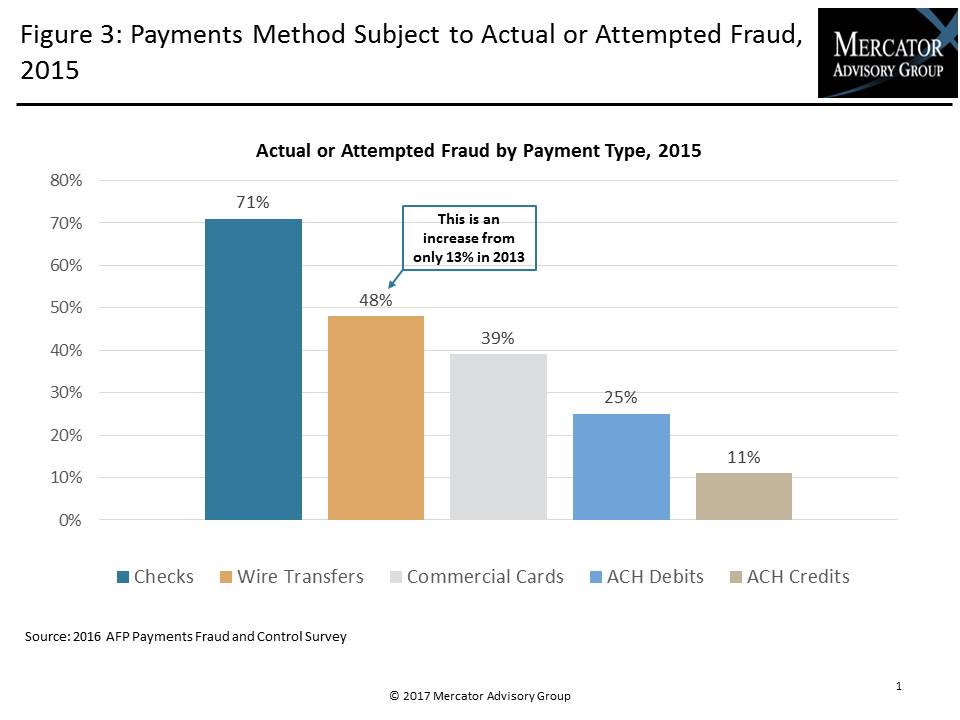

One of the exhibits included in this report:

- Reasons for the increased cyber threat and resulting potential economic impact

- A discussion of the extra costs associated with data breaches, going beyond actual financial losses

- Trends in payments fraud and reasons for the recent incidence uptick

- A view of the vendor landscape of technology and services solution providers

- Methods that companies can use to combat payments fraud, including using external partners

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world