Financing Commercial Trade: The Search for Liquidity

- Date:May 01, 2020

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

Various forms of trade finance have always been available to create liquidity in both domestic and international trade in goods and services. Financial professionals have increased their knowledge of the benefits associated with the increasing number of tools available in the space, including supply chain finance in managing working capital. Technology companies, in partnership with financial institutions, are also at the vanguard of testing and rolling out blockchain networks to provide safer and faster supply chain management. Small businesses also seek alternative forms of finance to manage cash flow and grow their businesses. Accessing and utilizing all of these tools have become even more important as we now face a global pandemic with expectations for recessionary aftershocks. This Mercator Advisory Group research report provides the latest views of the trade finance market, including expected reverberations of the COVID-19 pandemic and expectations going forward.

Mercator Advisory Group’s latest research report, Financing Commercial Trade: The Search for Liquidity, provides a direct view into the latest trends in technology and tools in the trade finance space. Traditional trade finance remains a primary method for managing risk and creating liquidity, especially for international commercial merchandise exports and imports. There are now more methods than ever before to access liquidity and promote both domestic and international flows of goods and services.

“One of the interesting things we discovered during discussions with industry participants has been a marked uptick in the recognition of working capital management effectiveness, particularly as the coronavirus sledgehammer policies hit businesses,” commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, author of the report, “so expectations for the adoption of these and other digital solutions have greatly increased.”

This research report is 16 pages long and has 7 exhibits.

Companies and other organizations mentioned in this report include ABN AMRO, Aion, ARK, Asian Development Bank, AstraZeneca, Bitcoin, Biz2Credit, BTC Relay, CBA, CGI, C2FO, Cosmos, Demica, Ethereum, Federal Reserve, Finastra, FIS, Fundera, GTC, Hyperledger, ICON, Infor Nexus, International Monetary Fund, Kabbage, komgo, Lending Tree, Lendio, Marco Polo, ondeck, Orbian, Polkadot, Prime Revenue, Prosper, PwC, r3, Ripple, SME Finance Forum, SoFi, Supply Chain Finance Community, Surecomp, SWIFT, Taulia, Temenos, Tradeshift, Voltron, Wanchain, we.trade, World Economic Forum, and World Trade Organization.

One of the exhibits included in this report:

Highlights of the report include:

- Discussion of the potential impact of COVID-19 on the economy and trade finance landscape.

- Breakdowns on various forms of liquidity being used for commercial trade, including traditional methods, open account, and alternative financing.

- Analysis of the nascent but growing commercialization of blockchain technology networks and their role in trade services.

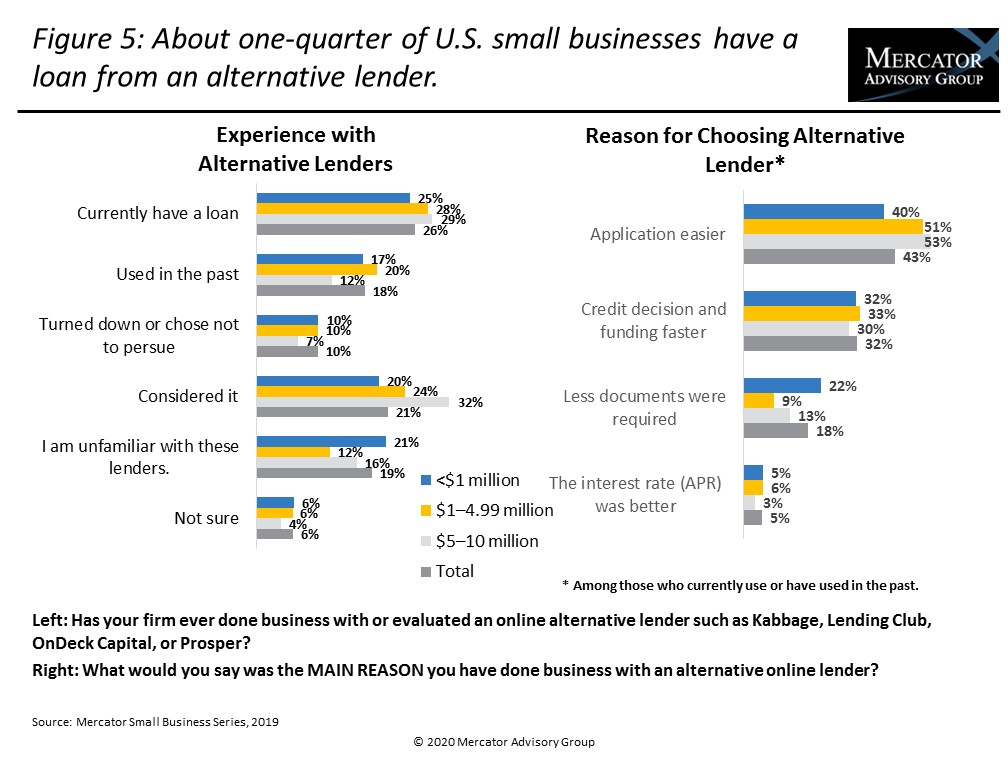

- Review of the impact on smaller businesses and how they are approaching the search for liquidity.

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world