International Commercial Card Markets Outlook: 2016–2021

- Date:April 11, 2018

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

The world continues to move in the direction of electronic payments, and this movement represents ongoing opportunity for card schemes across the globe. Companies operating in both developed and developing economies seek more efficiencies and value from business-to-business (B2B) invoiced payments, which card schemes can provide through credit facilities, potential revenue share, and “risk-minimized” virtual card accounts. The major regional commercial credit card markets outside North America continue to grow, although the pace varies depending on location and product.

In a new research report, International Commercial Card Markets Outlook: 2016-2021, Mercator Advisory Group examines the commercial card markets in the Western Europe, Asia-Pacific, and Latin America and Caribbean (LAC) regions with respect to specific market trends, key concerns, and spending volume growth through 2021.

“In these markets spending growth has historically been underpinned by corporate cards (mostly travel and entertainment, T&E), which in turn partially relates to economic growth and business budgets,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “However, the B2B market now has the fastest growth rates through virtual card numbers, also known as single-use accounts. Headwinds remain in the form of regulations as well as longer-term potential threats from new payment schemes, but the general outlook for commercial cards is strong through the next four years.”

The document is 21 pages long and contains 8 exhibits.

Companies mentioned in this report include: American Express, Apptivo, Certify, China UnionPay, Concur, Conferma, Diners Club, Early Warning Services, E-Global, Fraedom, HSBC, Invapay, iPara, JCB, Mastercard, Optal, PROSA, Visa, Zazoo, and Zoho.

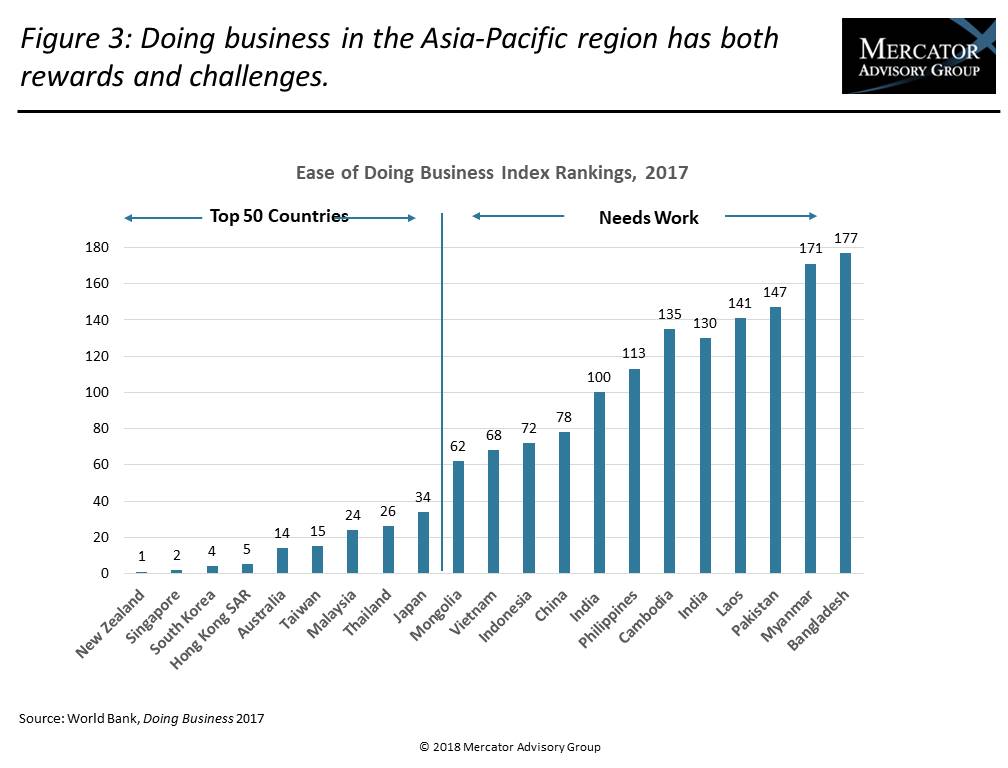

One of the exhibits included in this report:

Highlights of the report include:

- Detailed reviews of the possible regulatory impacts from various legislative initiatives, both in effect and follow-on, particularly the European Union’s revised Payment Service Directive (PSD2) and Interchange Fee Reform (IFR) and Australian rate caps

- Analysis and forecasts for key Asia-Pacific markets (including ASEAN) regarding trends and growth potential for commercial cards

- New Mercator coverage detail on LAC, including market discussions of Brazil and Mexico

- Market spending forecasts by commercial card product type through 2021 for all major markets covered in the report

- A dashboard on product and network share by region

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world