Merchant, Bank Mobile Wallets Prove Value Where Apple, Google, Samsung Have Not

- Date:August 11, 2016

- Author(s):

- Emmett Higdon

- Report Details: 28 pages, 14 graphics

- Research Topic(s):

- Mobile & Online Banking

- Digital Banking

- PAID CONTENT

Overview

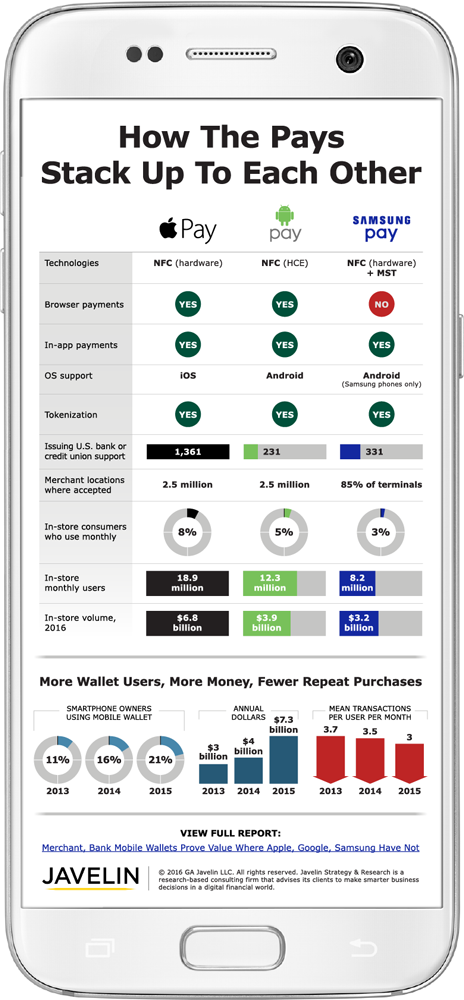

The number of banks, merchants, and card issuers offering their own mobile wallets seemingly grows every week in 2016, confirming that interest in mobile proximity payments has never been hotter. Yet, while mobile wallet dollar volume and total new users both continue to rise, the increases mask an insidious trend — mean monthly mobile wallet purchasing has dipped 20% over three years. Most mobile wallet providers, in particular the three major “Pays” — Apple Pay, Android Pay, and Samsung Pay — are failing to show consumers clear reasons to reach for their phones instead of their credit or debit cards. This report explores how the Pays stack up and recommends strategies to drive repeat purchasing behavior by creating value all along the purchase journey, not just at the point of payment.

Key topics discussed in this report:

- How does adoption of Android Pay, Apple Pay, and Samsung Pay compare by users and dollars?

- What functionality sets the Pays apart from one another?

- Who are mobile wallet early adopters?

- What must the Pays do to grow mobile wallet adoption?

- What additional mobile wallet features are most attractive to consumers?

- How are merchants and card issuers succeeding in attracting consumers to their wallets?

View Infographic: How The Pays Stack Up To Each Other

Companies Mentioned: Ally Bank, Apple, Bank of America, Burger King, Capital One, Citi, Dunkin’ Donuts, Citibank, Facebook, Fifth Third Bank, Google, MasterCard, McDonald’s, Netflix, Paydiant, PayPa, PNC, Snapchat, SunTrust, Visa, Wells Fargo

Methodology

The consumer data in this report is based on information collected from several Javelin surveys that targeted populations representative of the overall U.S. population in proportions of gender, age, and income:

- A random-sample panel of 3,000 respondents collected online during September 2015. The overall margin of sampling error is +1.79 percentage points at the 95% confidence level.

- A random-sample panel of 3,195 consumers with mobile phones or smartphones from June to July 2015. The overall margin of sampling error is +1.73 percentage points at the 95% confidence level

- A random-sample panel of 10,639 respondents collected online in May 2016. The overall margin of error is +0.95 percentage points at the 95% confidence level.

Learn More About This Report & Javelin

Related content

Security Centers in Digital Banking: How to Tell an Empowering Story of Prevention, Detection, and Resolution

Javelin Strategy & Research’s analysis of security centers at seven top-performing financial institutions reveals widespread gaps in empowerment features and a failure to tell a co...

Money Movement Hubs: Boosting the Value of FIs’ Most Commoditized Features

Javelin’s analysis of six top U.S. banks assesses their progress in developing dynamic money movement hubs that enable customers to manage payments, forecast cash flow, and weigh o...

Data Snapshot: The Definition of ‘Family’ Is Evolving

The percentage of unmarried cohabiting couples has skyrocketed in recent years, yet banking products and digital access and experiences still assume traditional household structure...

Make informed decisions in a digital financial world