Mobile Usage in Commercial Payments May Be Just Around the Corner

- Date:June 14, 2017

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

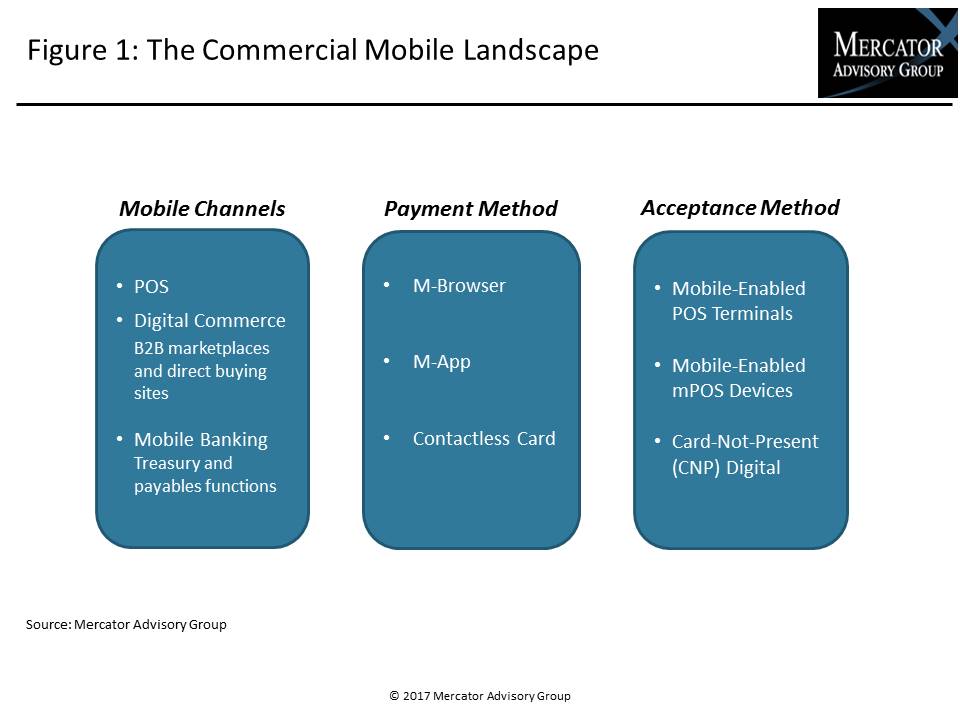

The new research report, breaks out and defines these channels, incorporating Mercator Advisory Group’s views as to the factors driving growth, and then providing a forecast of mobile spend through the relevant channels up to 2024.

"Many of us know from personal experience about the difficulty of finding consistent mobile payment point-of-sale (POS) capabilities in our normal daily shopping and spending routines, not to mention the different experiences and general ongoing confusion with regard to EMV. But all this is gradually improving, and in light of a clear generational preference for mobile by Millennials and Gen Z, along with increasing solutions from card issuers, we see a tipping point coming,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “Also, let’s not forget the impact of expanding business-to-business marketplace solutions, which will help drive remote mobile spending through a natural transition in the office place over time.”

The document is 16 pages long and contains 4 exhibits.

Companies mentioned in this research report include: Alibaba, Amazon, American Express, Apple, Axletree, Basware, Bloomberg, Citi, Coupa, FIS, First Data, Ingenico, JP Morgan Chase, Kyriba, Misys, PAX, Reval, Square, TSYS, US Bank, Verifone, and Wells Fargo.

One of the exhibits included in this report:

- Breakout descriptions of various business-to-business channels where corporate mobile solutions are used

- Growth drivers for POS and digital commerce

- Projected spend volume and growth over a 10-year timeframe

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world