The Outlook for Commercial Mobile Payments

- Date:July 27, 2016

- Author(s):

- The Outlook for Commercial Mobile Payments

- Research Topic(s):

- Commercial & Enterprise

- Emerging

- PAID CONTENT

Overview

In this research note, The Outlook for Commercial Mobile Payments Mercator Advisory Group details a number of converging factors that suggest how commercial mobile payments may indeed gain faster adoption than many expect.

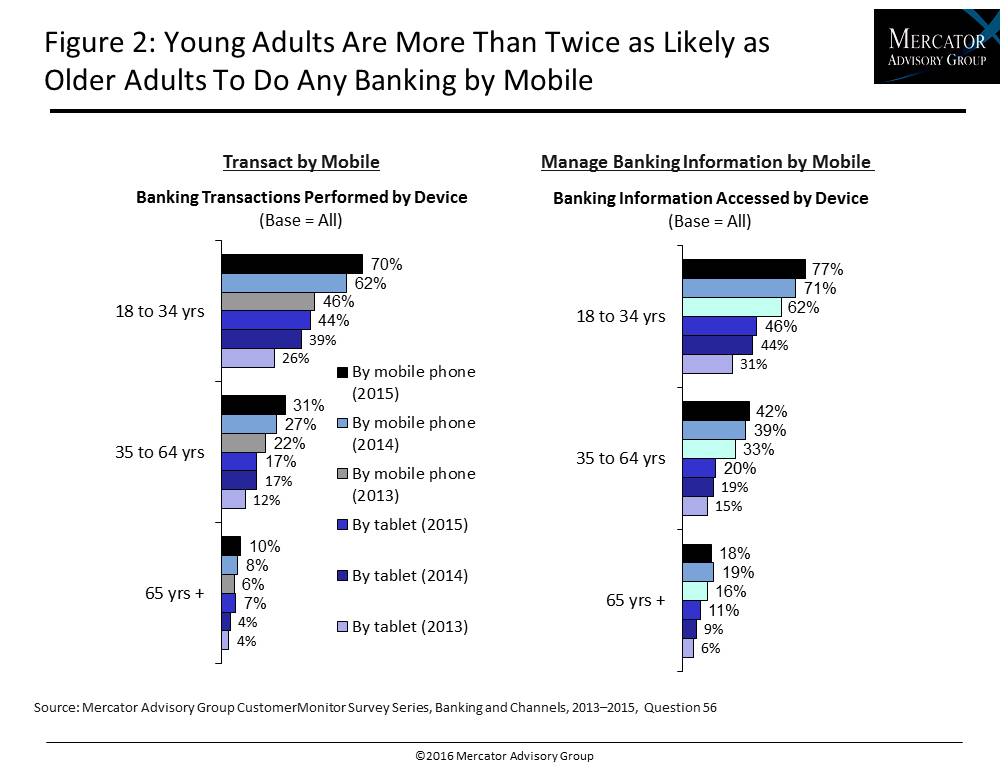

One factor is demographics: “The number of millennials entering the workforce is rapidly accelerating: 70% of adults ranging in age from 18 to 34 conducted some form of banking transaction (including payments) via a mobile phone during 2015 according to Mercator Advisory Group’s CustomerMonitor Survey Series,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “This compares to 31% for those between 35 and 65 years of age. This shift in preferences for mobile banking relationships among younger adults should also contribute to more rapid commercial mobile payments demand as the near-term point-of-sale environment evolves.

The note is 10 pages long and contains 3 exhibits.

Companies mentioned in this research note include American Express, Citibank, JPMorgan Chase, and U.S. Bank.

One of the exhibits included in this report:

- The current state of mobile payments adoption

- Graphical data from results of Mercator primary research on mobile banking and mobile payments

- Key momentum builders for commercial mobile adoption

- A point of view on the potential timeline for a tipping point in mass mobile payment adoption

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world