The U.S. Commercial Card Market: A Growing Virtual Reality

- Date:September 14, 2016

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

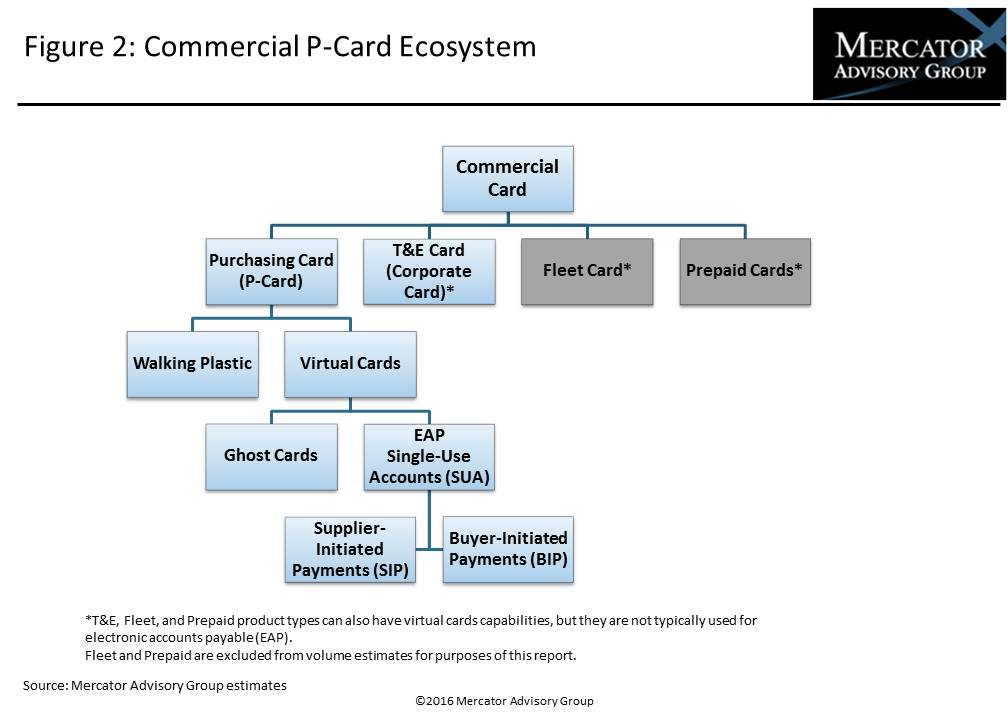

In a new research report, The U.S. Commercial Card Market: A Growing Virtual Reality Mercator Advisory Group reviews the corporate purchasing and virtual credit card landscape for the mid to large corporate market sectors. The report discusses how virtual card payments, led by single-use accounts (SUA), are driving the current growth trends.

"The increase in U.S. commercial card purchase volume in 2015 was largely driven by P-card-related spend, including virtual accounts in both reusable and single-use forms. Traditional commercial card accounts (walking plastics for both travel and procurement) continue to grow between 4% and 7% combined,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “That portion of the market is more heavily dependent on economic indicators like GDP. But double-digit growth in EAP has been the driving force behind the recent higher commercial card growth. Mercator Advisory Group expects that this trend will continue over the next four years”.

The research report is 20 pages long and contains 7 exhibits.

Companies mentioned in this report include AOC, Bora Payment Systems, Comdata, CSI Enterprises, Verient, and WEX.

One of the exhibits included in this report:

Highlights of the research report include:

- A review of the current factors contributing to the growth of business-to-business (B2B) payments overall and commercial cards specifically

- A detailed review of the products in the commercial cards space

- Growth projections for commercial credit card product types through 2019

- Detailed reviews of electronic accounts payable (EAP) and the factors behind surging single-use account (SUA) spend

- Network, issuer, and market sector views and perspective

- A discussion of the opportunities and potential threats in the U.S. commercial card industry

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world