- Home

- Payments Research

Payments

People’s decisions about where to shop and how to pay their bills hinge on a series of factors, including their grasp of technology, social media influences, demographics, and access to credit. Javelin’s analysts monitor this ever-changing landscape to provide data and insight through three practices: payments, cryptocurrency and small business digital banking & payments.

What shapes consumer transactions and payment technologies, and where is it going?

Any conventional wisdom about payments—how they’re made, the currencies being used, the cards presently in favor—doesn’t last long before the next wave of technology, innovation, and regulation. Javelin’s analysts conduct research at the forefront of payments, identifying the emerging trends for financial services companies and payments providers and offering insight into how they can best position themselves not just for what is current but also for what is coming.

Payments Research

2017 Outlook: Debit

- Impact Note

- Date: December 16, 2016

- Author(s): Sarah Grotta

- Research Topic(s): Debit

2017 Outlook: Emerging Technologies

- Impact Note

- Date: December 16, 2016

- Author(s): Tim Sloane

- Research Topic(s): Emerging

2017 Outlook: Merchant Services

2017 Outlook: Prepaid

- Impact Note

- Date: December 16, 2016

- Author(s): Ben Jackson

- Research Topic(s): Prepaid

Toward a Theory and Practice of Data in an Always-On World

- Impact Note

- Date: December 15, 2016

- Author(s): Ben Jackson

- Research Topic(s): Emerging

Company Snapshot: Splitit

- Impact Note

- Date: December 13, 2016

- Author(s): Joseph Walent

- Research Topic(s): Merchant

Future Trends for Digital Banking and Payments

- Whitepaper

- Date: December 13, 2016

- Author(s): Emmett Higdon, Ian Benton, Jacob Jegher, Mark Schwanhausser

- Research Topic(s): Cybersecurity, Fraud Management, Digital Strategy & Experience, Mobile & Online Banking, Tech & Infrastructure, Small Business, Digital Banking, Fraud & Security

Company Snapshot: Riskified

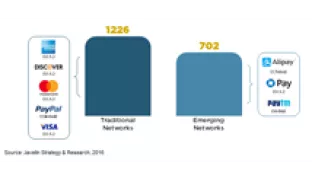

The New Payment Networks Vs. The World (Traditional Networks)

- Whitepaper

- Date: December 12, 2016

- Author(s): Michael Moeser

- Research Topic(s): Tech & Infrastructure

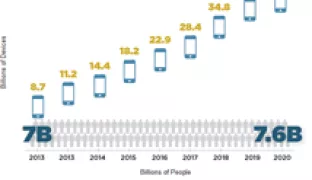

The Rise In The Internet Of Payments

- Whitepaper

- Date: December 12, 2016

- Author(s): Michael Moeser

- Research Topic(s): Tech & Infrastructure